After reporting in-line earnings in the third quarter of 2017, Office Depot, Inc. ODP delivered a positive earnings surprise of 14.3% in the fourth quarter. Meanwhile, the top line came ahead of the Zacks Consensus Estimate for the second straight quarter. But despite reporting better-than-expected results, shares of this Zacks Rank #3 (Hold) company plunged 16% following the results.

It seems that investors’ apprehension about the stock stems from dwindling top and bottom-line performance. Further, management’s soft earnings projection and bleak adjusted operating income view for 2018 alarmed investors. Management hinted that incremental growth investments to catapult it into a services-driven company and reduced sales volume are the primary reasons behind lower adjusted operating income.

Nevertheless, the company anticipates that sales from the new growth endeavors may help mitigate the impact of lower store volume, prior year store closures and adoption of new revenue recognition standards, to an extent. The company also informed that it has completed the integration with OfficeMax and decided to tread slowly on store closure path. The company plans to close 20 net stores in 2018.

The company is trying all means to give itself a complete makeover. This seems evident as demand for office products (paper-based) has been decreasing due to technological advancements. Smartphones, tablets and laptops are fast emerging as viable substitutes for paper-based office supplies. Further, stiff competition from online retailers such as Amazon AMZN and lower traffic count in retail stores have been playing spoilsport.

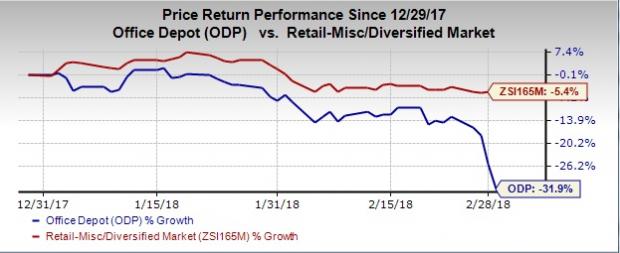

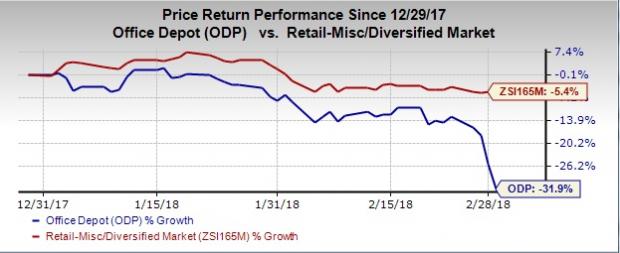

The reflection of the same is quite visible from the stock’s performance in the bourses. So far in the year, shares of the company have nosedived 31.9%, wider than the industry’s decline of 5.4%.

Quarterly Results

This office supplies retailer delivered adjusted earnings per share from continuing operations of 8 cents that beat the Zacks Consensus Estimate by a penny but declined 27% from the prior-year quarter, as the top line continues to struggle. The company generated sales of $2,581 million that fared better than the consensus mark of $2,541 million but fell 5% year over year.

For quite some time now, Office Depot has been grappling with dwindling top-line performance. Nevertheless, the company is closing underperforming stores, reducing exposure to higher dollar-value inventory items, shuttering non-critical distribution facilities, concentrating on e-commerce platforms as well as focusing on offering innovative products and services.

Gross profit fell 7% year over year to $607 million, while gross margin contracted 50 basis points (bps) to 23.5%. Adjusted operating income came in at $95 million, down from $96 million (excluding $15 million from the additional 53rd week) reported in the year-ago period, while adjusted operating margin remained flat 3.7%.

Leave A Comment