90% (my low-balled estimate) of you, the investing public, are herding when it comes to the bond market. You may not know it because the overwhelming psychological atmosphere is to reaffirm, not question peoples’ behavior. That is what herding is; a comforting feeling of going with the flow and being at one with your environment and the greater zeitgeist.

Now, please don’t be offended by the title; you dear reader may well be one of the 10%. But out there in the financial investment realm, they are herding, BIG time, as bond yields are expected to continue rising, because… media; because… “Great Rotation, part 2” and because… the story of epic secular changes and the chance to be early and clued in to a great new market phase are so alluring.

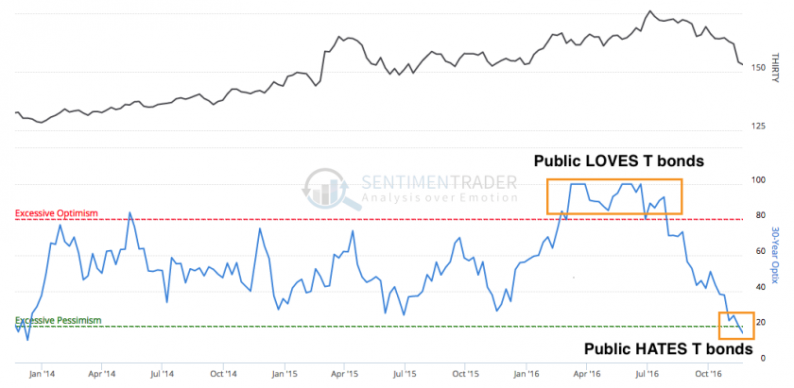

Bonds may well be about to change to bearish, but yields (which go in the other direction) have not even hit the points that have limited them historically, so why not tap the breaks on the hysterics until such time as the great secular change actually takes place? I mean, just last summer 90% of ‘you’ were in full belief mode about NIRP. Think about that. You were buying the Zero and Negative interest rates story hook, line and sinker.

You are now being tended by the financial media, which has never given you a bum steer before (ha ha ha… ) to believe that something that has not happened in decades is on the verge of happening now. I have reason to believe you may even be right, as that ‘all-in to the NIRP!’ side of the boat last summer was indeed a spectacularly emotional, potential bull-ender. But… the public is getting all in on the rising yields story even as the ‘limiter’, AKA the 100 month EMA, on the 30 year yield is rapidly approaching.

Don’t get me wrong; I believe that the bond market bull should end. Just look at this chart and tell me how good a job the bond vigilantes have been doing over the last few decades or so. The answer is that they haven’t been doing their job because they don’t exist.

Leave A Comment