From one perspective the move from active, human portfolio decision making to passive, computer-driven investment management mirrors societal trend shifts to various degrees. The impact automated intelligence has on a job function, for instance, transforms the human from a leader to a follower to various degrees. In a human / computer artificial intelligence integration project, computers often frame decisions, provide probability path analysis, and point the human in a direction to make a decision. The same can be seen in how high passive ETF participation are impacting active stock management. A new study from hedge fund portfolio management services firm Symmetric highlights just how deadened key stocks have become to the most important idiosyncratic performance driver of all: earnings.

Stocks with high passive ETF participation simply don’t respond to earnings the same as those without ETF influence

A key basis of supply and demand market theory is found in understanding the nature of the performance driver. In a traditional market environment, earnings have been a key driver of demand, with supply being constant.

This obvious performance driver is starting to change the supply and demand landscape, calling into question the impact passive market demand is having on an “efficient market.”

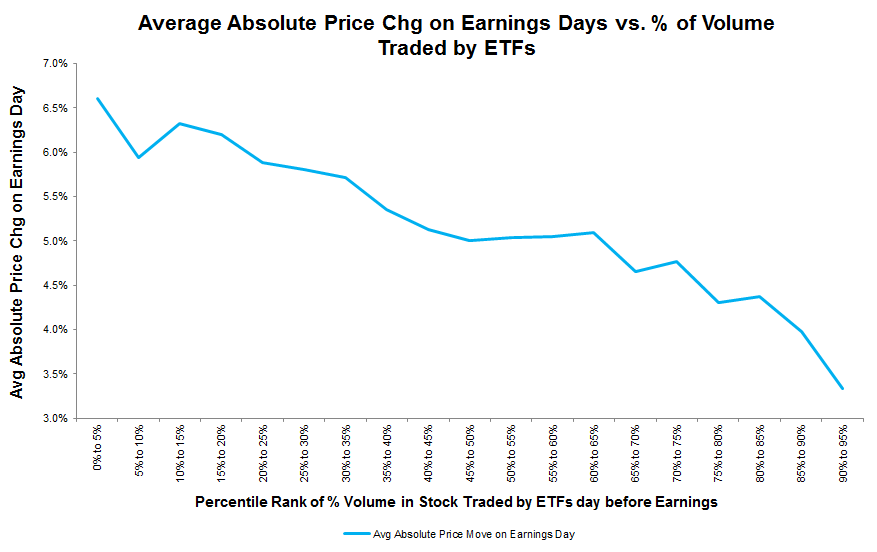

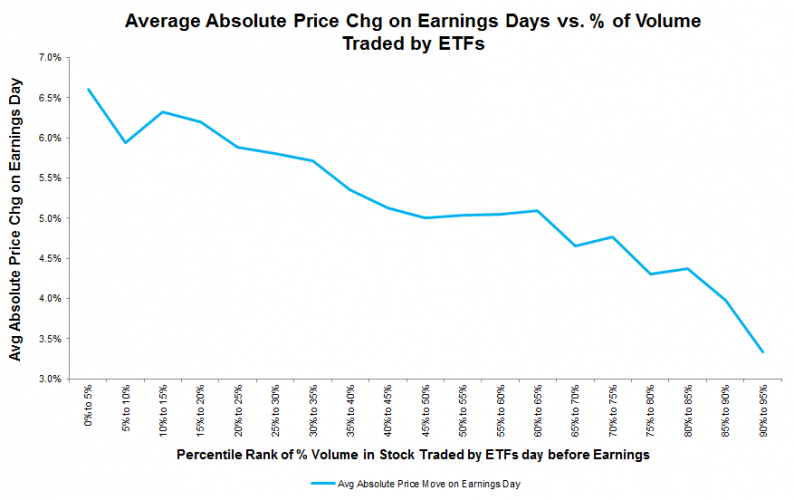

Stocks with high passive ETF participation exhibit a deadened response to earnings, the report noted.

“The analysis confirms a relationship between ETF trading of a stock and the likelihood that a stock will respond to its earnings release,” with increased non-econoimc, passive buying exacerbating the trend. “The more a stock’s volume is driven by ETF trading, the less it is likely to move on earnings day in response to stock specific news.”

Benchmarking the responsiveness of a stock to earnings based on volatility prior to and in trading immediately after earnings announcements, stocks with large ETF participation “may not be trading according to their fundamentals,” the report observed. “In the case of heavy, corresponding ETF volume, they may be trading more in line with the supply and demand for the ETFs that hold the stock than how the company is performing.”

Leave A Comment