Goldman Sachs has helpfully announced that any financial repercussions from the attacks in Paris will be short-lived, and the political repercussions will be medium-term: Increased uncertainty likely to weigh on activity and increase market volatility in the short run (via Zero Hedge).

The analogies invoked to support this rosy view are the attacks in Madrid in 2004 and in London in 2005–tragedies that weighed very briefly on the global orgy of financial gains between 2003 and 2007.

But isn’t it obvious that the world of November 2015 is not the world of 2004? The global economy is not in a cycle of robust expansion of debt, wages, consumption, profits and stock valuations as it was in 2004.

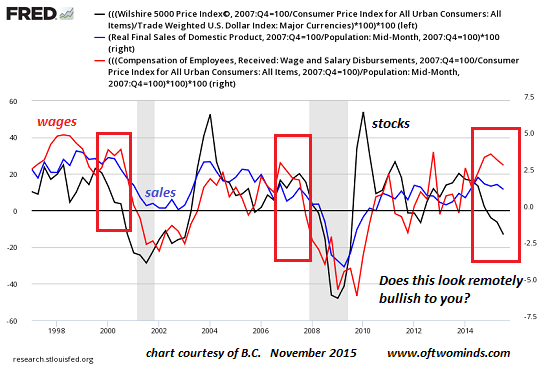

Now, debt is softening or being revealed as impaired, wages are stagnant for the bottom 90%, real sales are down once subprime-auto-loan enabled vehicle purchases are subtracted, profits and forward projections for sales are crumbling, along with stock valuations.

The global financial system is fragile and vulnerable. Any number of relatively modest changes could push the entire shaky contraption off the cliff:

1. any increase in private-sector interest rates, for any reason

2. any faltering of global sentiment

3. externalities (disruptions from weather, war, shortages, a.k.a. grey swans)

4. unexpected crises (a.k.a. black swans)

5. any toppling-domino-like failure of counterparties as defaults pile up

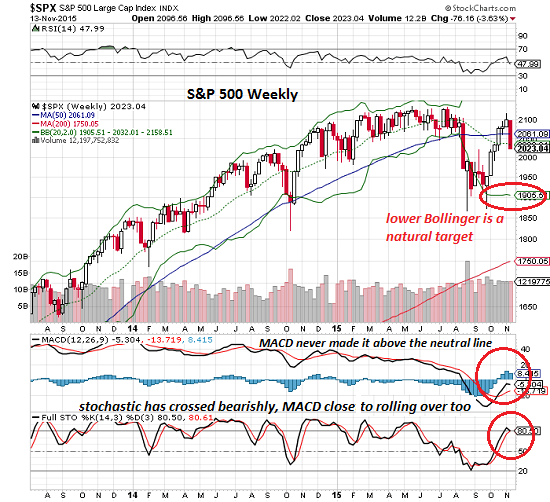

Does this weekly chart of the S&P 500 look remotely bullish? Stochastics have rolled over in a “sell” signal, and MACD couldn’t even claw its way above the neutral line. Now MACD is also poised to roll over into a sell.

Does this chart of stocks, wages and real final sales look remotely bullish? Notice that all three have turned down, echoing the recessions and stock market collapses of 2001 and 2008.

It’s not just tourism and retail sales that might swoon–global sentiment might switch decisively from “risk-on” to “risk-off” with far-reaching consequences, a reversal that would quickly cascade through every asset class and every market–not just in the short-term, but in the long term.

Leave A Comment