In today’s precious metals analysis, I focus on platinum-palladium prices and ratios over the past 48 years.

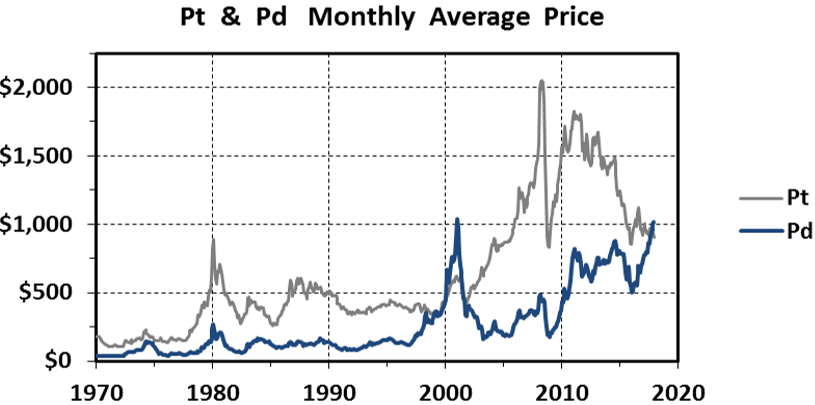

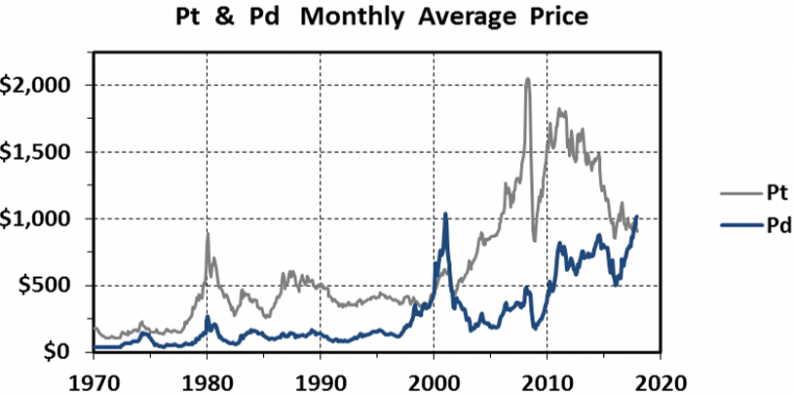

A monthly average price chart for both metals from January 1970 to December 2017 is shown below. Note that while platinum was free-trading, palladium was fixed at $35-36/oz until mid-1972. We use London pm closing prices from Kitco.com.

The price charts show similar patterns and a general correlation of platinum and palladium prices. That said, there have been times when one is more volatile than the other, both metals are subject to parabolic spikes, and on occasion, their prices are strongly divergent.

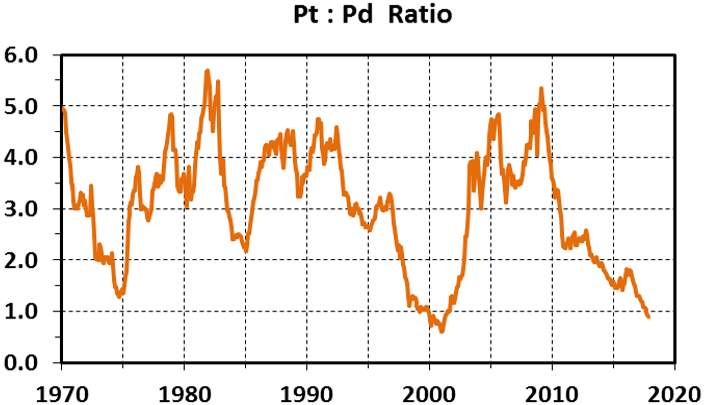

As a result, platinum to palladium ratios show wide variance over the 48-year period and range from highs above 5.0 to lows below 1.0:

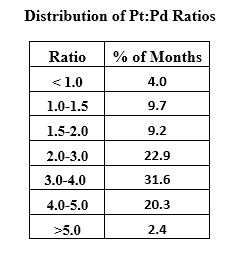

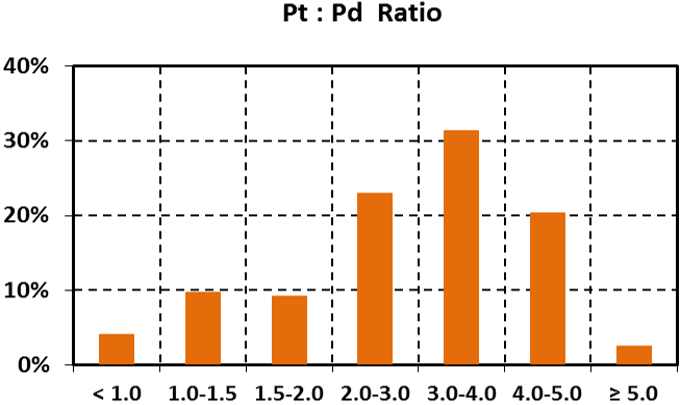

Our data set covers 576 months. The distribution of ratios in both tabular and chart format follows:

From our data set and the distributions of monthly average platinum-palladium ratios from January 1970 thru December 2017, I can glean the following:

Platinum and palladium are both small markets. According to the USGS, world production in 2015 was 189 tonnes of Pt and 216 tonnes of Pd and 2016 estimates are 176 tonnes and 208 tonnes respectively. Compare these mined supplies with the 2016 production of gold at 3100 tonnes.

Leave A Comment