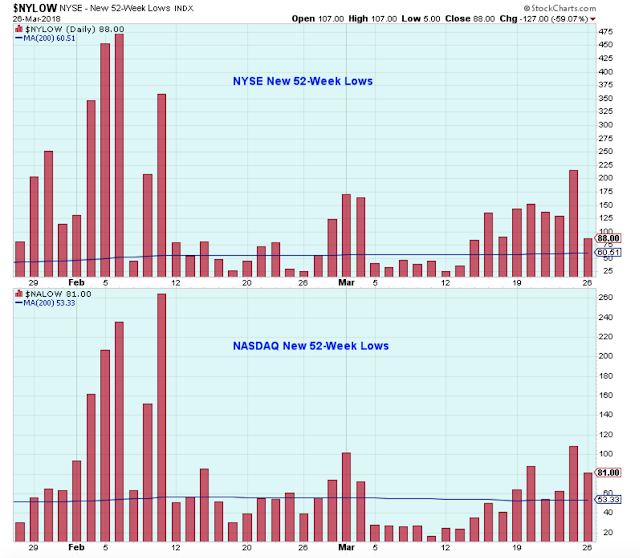

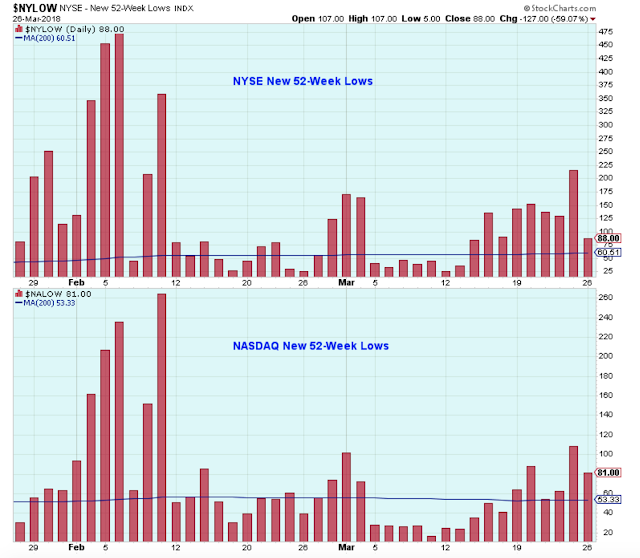

Nice market today! Things are definitely looking a lot better than last week. I don’t think we can declare a new uptrend quite yet though because the new 52-week lows are still a bit too elevated.

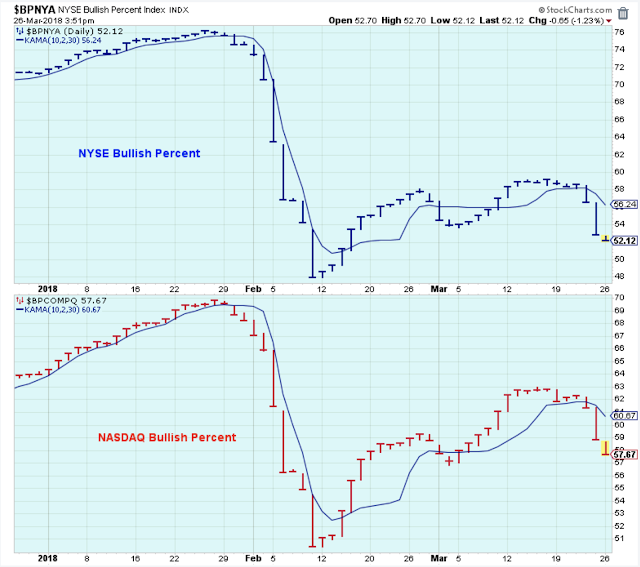

In addition, the bullish percents continued to drift lower today, although sometimes these indicators don’t turn as quickly as the others. Still, this isn’t the look of an uptrend yet.

Maybe we’ll continue to get these dramatic, headline-driven moves up and down in the market until this trading pattern shown below is broken.

US Dollar weakness continues.

International bond ETFs are breaking to new highs.

US Treasury Bonds may be ready to trend higher. For how long, I am not sure. Sentiment has been overwhelmingly negative towards US Treasuries, so a rally here makes sense from a contrarian view.

I like the looks of this ETF.

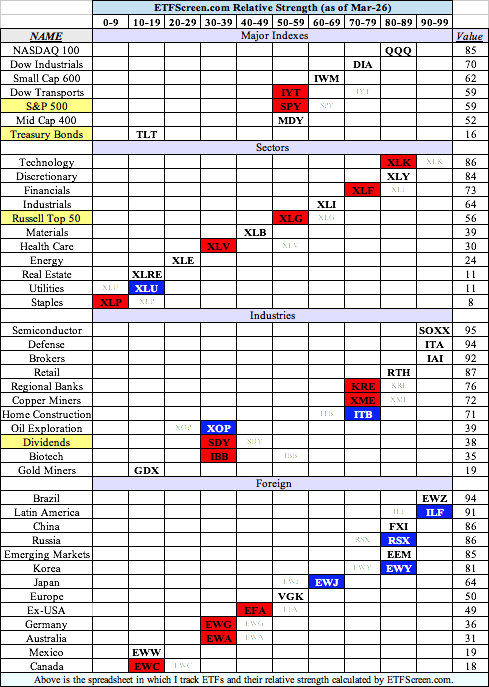

Sector Strength

Stick with the areas of market showing the best relative strength which includes Technology, Defense, Banks, Brokers and Emerging Markets.

I continue to be surprised by the strength of Consumer Discretionary, and I am not sure about the Copper Miners.

It is tempting to buy some of the laggards, but I rarely do well buying groups that are performing poorly. I usually get discouraged and sell before they have time to start to perform.

Outlook Summary:

I am expecting a choppy, headline-driven, sideways market between now and the November elections. I still plan to buy the dips for short-term gain, but over time I plan to continue to reduce my overall exposure to stocks.

The expected US economic growth rate is back down to the 2% level.

Higher rates are now a headwind for US stocks. The recent tax cut, the 300 billion spending increase, and the already out-of-control federal deficit are a set up for a very dangerous spike in interest rates.

Leave A Comment