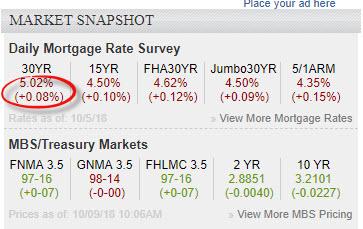

For the first time since Feb 2011, US 30Y mortgage rates have topped 5.0%, according to Mortgage News Daily.

As CNBC reports, the average rate on the 30-year fixed loan sat just below 4% a year ago, after dropping below 3.5% in 2016. It just crossed the 5% mark. That is the first time in eight years, and it is poised to move higher. Five percent may still be historically cheap, but higher rates, combined with other challenges facing today’s housing market could cause potential buyers to pull back.

“Five percent is definitely an emotional level inasmuch as it scares prospective buyers about how high rates may continue to go”, said Matthew Graham, chief operating officer of MND.

US Homebuilder stocks have tracked dismal housing data lower for much of the year but the last few days have seen them accelerate lower (amid a record losing streak) amid The Fed’s increasingly hawkish testimony…

Higher rates, however, could throw cold water on today’s overheated home prices, as sellers see demand fall off and their houses sit on the market longer. The number of price cuts is rising quickly, signaling that sellers, and their expectations, are in fact coming back down to earth.

“The economy seems to be coasting upward. But this kind of complacency, this kind of confidence can be volatile”, Robert Shiller, co-creator of the S&P CoreLogic Case-Shiller Home Price Indices, said in an interview on CNBC’s “Squawk on the Street”.

“The question is, is this a turning point in the housing market. I’m a little bit worried about that but not ready to call that”.

As we noted yesterday, in some luxury markets, such as Manhattan, price increases have also been damped by increased federal scrutiny of foreign buyers, a trend that will probably continue given the nationalistic stance of the current administration in the White House. Because the aggregate statistics are so skewed towards the high-end markets, those shifts are worth paying attention to.

Leave A Comment