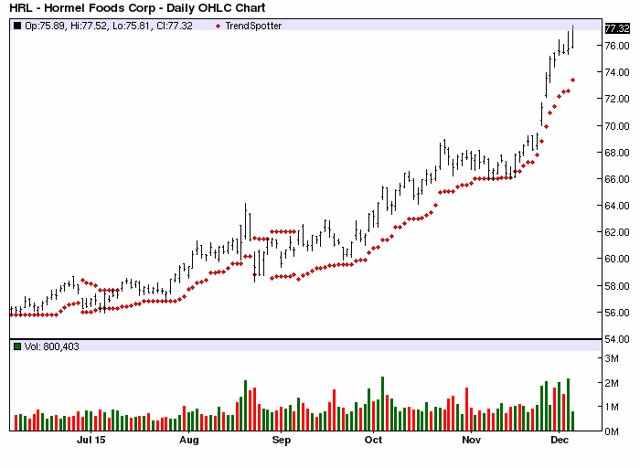

Hormel Foods (NYSE:HRL) is the Barchart Chart of the Day. The meat products company has a Trend Spotter buy signal, a Weighted Alpha of 56.00+ and gained 46.91% in the last year.

The Chart of the Day belongs to Hormel Foods. I found the meat products stock by using Barchart to sort the Russell 3000 Index stocks first for the highest number of new highs in the last month, then I reviewed the chart using the Flipchart feature. Since the Trend Spotter signaled a buy on 8/28 the stock gained 25.59%.

Hormel Foods Corporation is a multinational manufacturer and marketer of consumer-branded meat and food products, many of which are among the best known and trusted in the food industry. Products manufactured by the corporation include hams, bacon, sausages, franks, canned luncheon meats, stews, chilies, hash, meat spreads, shelf-stable microwaveable entrees, salsas and frozen processed foods. These selections are sold to retail, food service and wholesale operations under many well-established trademarks.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

Fundamental factors:

Leave A Comment