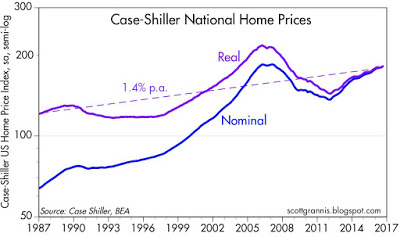

Over long periods, the inflation-adjusted price of homes in the U.S. has tended to increase by a little more than 1% per year. However, this doesn’t mean that owning a home is a good way to make a 1% real return on your money.[Let me explain.]

Written by Scott Grannis (Calafia Beach Pundit)

According to the Census Bureau, new homes have been getting bigger and bigger: since 1973, the average new house increased from 1660 square feet to 2687 square feet, for an annualized increase of 1.15%. New homes today are 1,000 square feet larger than they were in 1973, and living space per person has nearly doubled. Bigger and better houses explain why inflation-adjusted home prices have increased by a little more than 1% per year. On balance, and over long periods, homes maintain their value, relative to other goods and services. They are a thus a decent inflation hedge, nothing more.

Conclusions

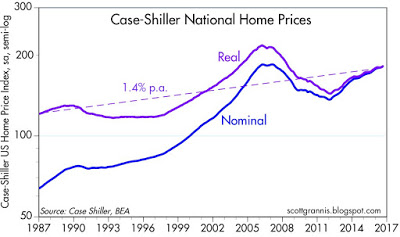

1. The first of the charts above shows indices of real and nominal national home prices since 1987, according to Case Shiller.

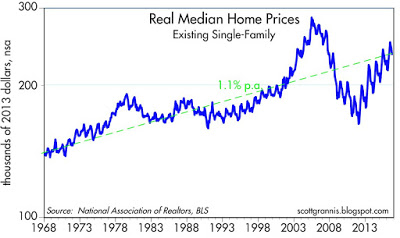

2. The second of the charts above shows real existing single-family home prices since 1968.

In short, housing has been a decent inflation hedge, holding its value over long periods – nothing more

Leave A Comment