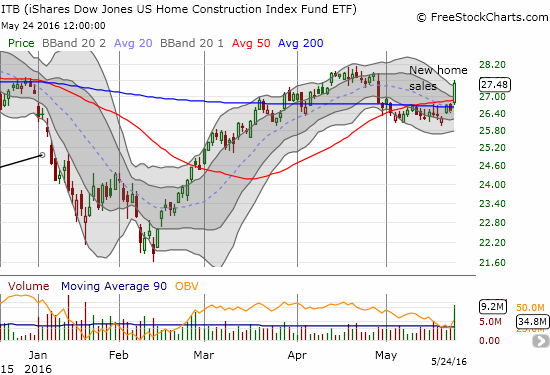

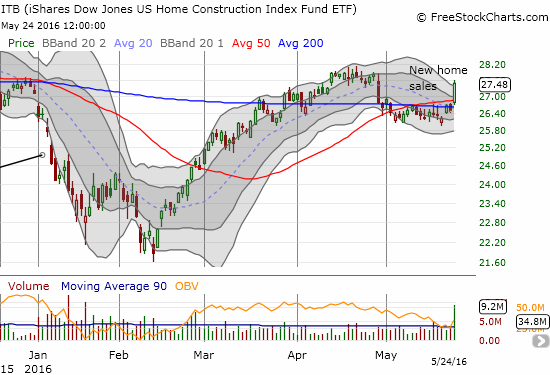

The last Housing Market Review covered data released in March, 2016. At the time, the iShares US Home Construction ETF (ITB) was accompanying the market on an extended rally from the February lows. Resistance at the 200-day moving average (DMA) slowed down the advance. In April, ITB cleanly broke through resistance only to come to a halt after a promising gap up. I took profits on a few more positions in home builders as the seasonal trade in home builders wound down down. ITB stayed resilient and hung around just long enough until a double catalyst of soaring new home sales and strong earnings from Toll Brothers (TOL) generated a fresh breakout on tremendous volume.

iShares US Home Construction (ITB) breaks out from 50 and 200-day moving average resistance on buying volume that has not been this large since the recovery from August’s flash crash.

Source: FreeStockCharts.com

Suddenly, the trade on home builders has taken on new life even as time ticks down to the next rate hike from the Federal Reserve. From a strictly technical perspective, ITB is a strong buy all over again; buying on all dips as long as ITB stays above 50 and 200DMA support makes plenty of sense. I have adjusted my strategy accordingly.

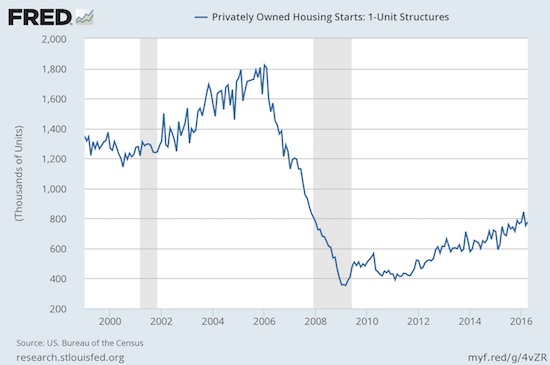

New Residential Construction (Housing Starts) – April, 2016

In the last Housing Market Review I noted how a plunge in housing starts completed a series of bad signs in housing indicators. This month, starts stabilized to cling to the overall uptrend. Given the breakout in new home sales (see below), starts should succeed in keeping close to trend.

Privately owned housing starts for 1-unit structures came in at 778,000 for April. The March 1-unit starts were revised downward to 753,000 from 764,000. So, the month-over-month change was a gain of 3.6%. The year-over-year growth was 4.3%. The chart below shows the strong uptrend remains in place.

After a large tumble, housing starts cling to the current uptrend

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, May 19, 2016.

The West stood out as the big loser for this report. Single unit starts dropped 14% from March, the second monthly drop in a row. Year-over-year, starts in the West dropped 20%. My concerns for the West region continue to grow as a result of this poor all-around performance. On the other hand, the South completely surprised me with an astounding 16% year-over-year jump that was also a 9% monthly gain. Is a new migration from the West to the South underway?

Leave A Comment