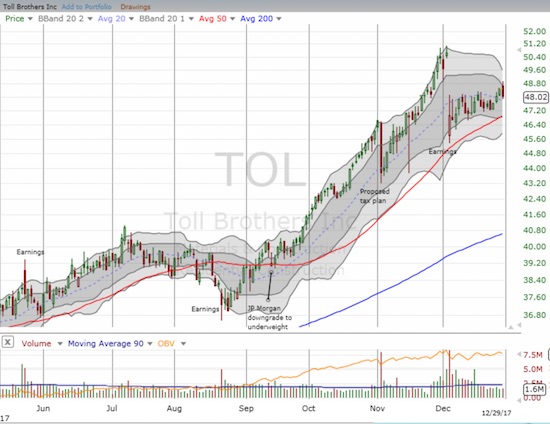

The last Housing Market Review covered data reported in November, 2017 for October, 2017. At the time, the iShares U.S. Home Construction ETF (ITB) traded at a 10+ year high with the angst of tax reform left far behind in the rear view mirror. The day after my post, Toll Brothers (TOL) reported earnings that disappointed the market. The sell-off was enough to knock ITB off its highs. ITB took almost the entire month of December to recover. TOL made a marginal new post-earnings high in the past week, but the overall effort to recoup losses looks lackluster. The good news is that support at the uptrending 50-day moving average (DMA) is holding firm.

The iShares US Home Construction ETF (ITB) spent much of December recovering from a Toll Brothers inspired sell-off. In the past week, ITB hit a new 10+ year high.

Source: FreeStockCharts.com

With bargains hard to find in the housing sector, I went ahead and nibbled on TOL by purchasing a few long-dated call options. The seasonally strong period for home builders began in November, so the risks shifted firmly in favor of the upside. My position in TOL is a “no regret” position: small enough to cause little pain if the trade fails and large enough to make a dent if the rally continues apace from here.

As the chart of ITB suggests, trading in most home builders was nondescript in December. There were three notable exceptions: Hovnanian (HOV), Meritage Homes (MTH), and LGI Homes (LGIH).

I rarely track Hovnanian (HOV) given the stock is in single-digits and the business has yet to demonstrate much of a post-recession recovery. However, the stock caught my attention in December and motivated me to review the overall stock chart. HOV bounced sharply from the financial crisis only to peak a little over a year later. In early 2016, HOV retested the 2011 low. HOV was on its way to a loss for the year until buyers suddenly surged into the stock in the second half of December. The move was a picture-perfect bounce off 50DMA support. This trading suggests to me that HOV got caught up in some of the manic moves often seen in single-digits stocks in holiday trading. Yet, the rally continued through earnings (with a slight hiccup). HOV gained 38% in the two weeks since it last tested 50DMA support. That is a move I cannot ignore.

Hovnanian (HOV) surged into year-end and managed to go positive for the year.

Meritage Homes has been at the top of my list for months, but I never got the entry point I wanted. MTH was one of the home builders that soared after the initial angst over the tax plan. The stock almost went parabolic at the end of November on no news that I could find. The cool-off period featured a near picture-perfect retest of 50DMA support. Given this may be as good as it gets for a dip for a while, I am positioning to start nibbling on MTH in January.

Meritage Homes reversed a near parabolic run-up in November. The selling ended right at 50DMA support. The stock looks refreshed and ready to run with the next sector rally.

Finally, LGI Homes (LGIH) is the home builder stock that does not know how to quit. This regional builder with a heavy concentration of business in Texas has hit numerous all-time highs in the second half of the year. I doubt I can get comfortable at these levels buying back into the stock, but I do like using LGIH as an indicator of the underlying strength of the housing market rally. In particular, LGIH is “burdened” by a short interest that is a massive 38.9% of the float. Skepticism clearly looms large over LGIH, but the momentum keeps shoving that skepticism to the sidelines.

Since June, LGI Homes (LGIH) has only taken a significant pause in August. Otherwise, the stock’s march upward has been near relentless.

I was honestly astonished at the synchronized strength in the housing numbers for November. Housing activity picked up in a big way and with it sentiment and confidence. This kind of momentum could be sustainable if wage gains make significant progress in 2018; but that is a big IF. Moreover, consumer and builder sentiment is already at lofty levels. I will be looking closely for what catalysts emerge to continue supporting this robust pace of housing market activity.

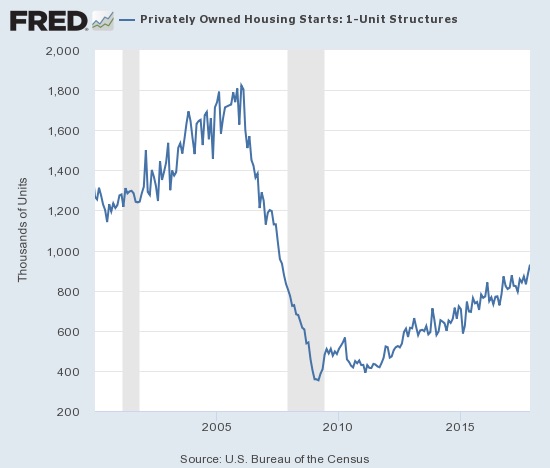

New Residential Construction (Housing Starts) – November, 2017

Single-family housing starts for October were revised upward from 877,000 to 883,000. November starts increased month-over-month by 5.3% to 930,000. On an annual basis, single-family housing starts jumped 13.0%, representing a quick turn-around from October’s minimal gain.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, December 19, 2017.

Housing starts soared and re-energized the existing uptrend.

After three months of non-dispersed regional changes, dispersion returned for September, October, and now November. The Northeast, Midwest, South, and West each changed 6.8%, -9.9%, 16.5%, and 24.4% respectively in November. The West delivered very strong growth again and provided fresh affirmation of the acute need for more housing in the West’s supply-constrained markets. The South is back in full throttle after a quick post hurricane recovery.

Leave A Comment