If you’re looking for action, the commodities sector has traditionally been a good place to find it.

With wild price swings, massive up-cycles, exciting resource discoveries, and extreme weather events all playing into things, there’s usually never a dull day in the sector. That being said, it’s hard to remember a more lackluster period for commodities than in the last couple of years.

For commodity bulls, the good news is that the sector is no longer tanking. The bad news, however, is that all the recent action has been in relatively niche sectors, as metals like cobalt, zinc, and lithium all have their day in the sun.

At the same time, the big commodities (gold, oil, copper) have all slid sideways, having yet to revisit their former periods of glory.

COMMODITY WINNERS SO FAR

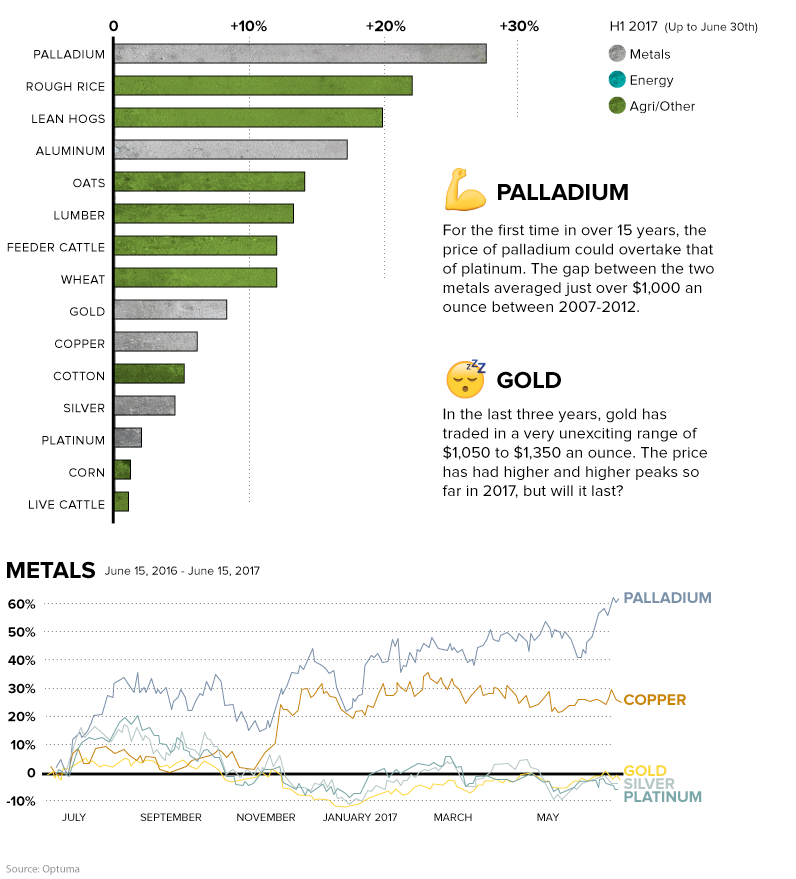

Before we highlight why commodities could still be cheap, let’s look at recent performance to get some context. Here are the commodities that have positive returns in H1 2017 so far:

Palladium is the best performer in 2017 so far, and it has now almost passed platinum in price. That would be the first time since 2001 that this has happened, and for the stretch of 2007-2012 it was even true that palladium traded at a $1,000 deficit to platinum.

Agricultural goods like rough rice, lean hogs, oats, and and wheat have also gotten more expensive so far this year. Meanwhile, metals like gold, copper, and silver have seen modest gains – but these are only after dismal performances from the last part of 2016.

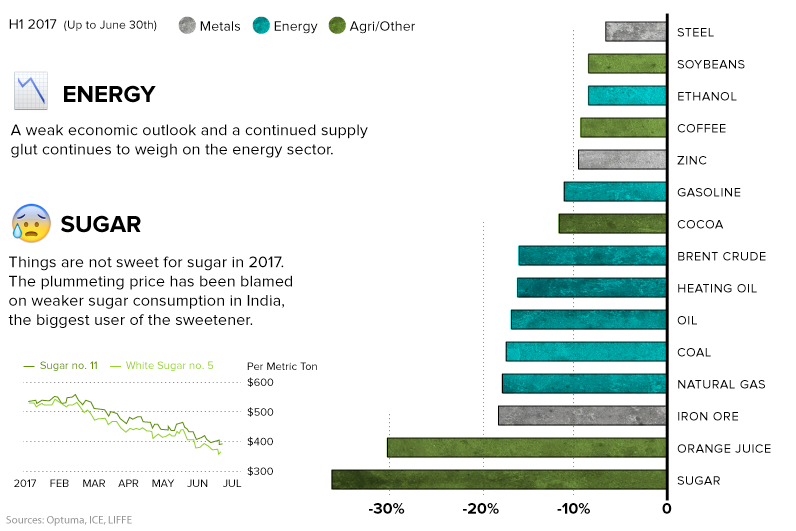

THE LOSERS SO FAR

Here is the scoreboard for the commodities in negative territory, with the most noticeable losses in sugar and energy.

ARE COMMODITIES CHEAP?

From the post-crisis bottom in 2009 until today, the S&P 500 is up a staggering 215.4%.

During that same timeframe, most major commodities crashed and then went sideways. The Goldman Sachs Commodity Index (GSCI) is down roughly -31.2%, which is an extreme juxtaposition to how equities have done.

Leave A Comment