General Electric Company (GE) is a diversified infrastructure and financial services company. The products and services of the Company range from aircraft engines, power generation, oil and gas production equipment, and household appliances to medical imaging, business and consumer financing and industrial products.

I Know First wrote an article about General Electric on Aug 27th 2015. The article argued that the company’s stock was Bullish in the long term mainly because It is having strong corrections of regulations such as the one the company just underwent. Since that time, the stock price has increased 27%.

General Electric Company (NYSE:GE) showed bearish trend with lower momentum of -0.39% to close at $30.37. The company traded total volume of 66,681,281 shares as compared to its average volume of 129.36 million shares. The company has a market value of $308.23 billion and about 10.11 billion shares outstanding. During the 52-week trading session the minimum price at which share price traded, registered at $19.37 and reached to max level of $30.99.

During the current month, Wall Street analysts gave the rating about the company shares. 4 analysts said BUY the stock and Strong BUY signal by 6. Sell rating was given by 0. Hold signal was recommended by 7 analysts. No one gave an Underperform rating

GE wanted to terminated its contract to sell its Appliances business to Electrolux and wanted to pursue other options to sell the Appliances business. GE is entitled to a break-up fee of $175 million from Electrolux. The Appliances business is performing well and GE will continue to run the business while it pursues a sale.

General Electric has called off a deal to sell its century-old appliance division to Electrolux of Sweden for $3.3 billion after the United States Justice Department moved to block the transaction, Electrolux said on Monday.

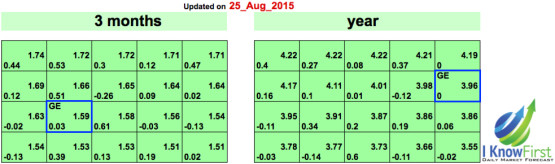

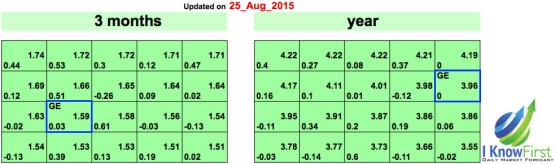

(Figure 1: GE forecast 25th August ’15)

Leave A Comment