Here is a glass of water. You’re holding it.

How heavy is it? The answer is: the actual weight probably doesn’t matter. It’s just a glass of water. What matters is how long you hold it.

Hold it for a minute, it’s no problem. An hour and your arm will ache. A day and your arm will feel paralysed.

The weight doesn’t change but the longer you hold it the heavier it becomes and the greater the probability you finally just have to put it down or risk dropping it altogether.

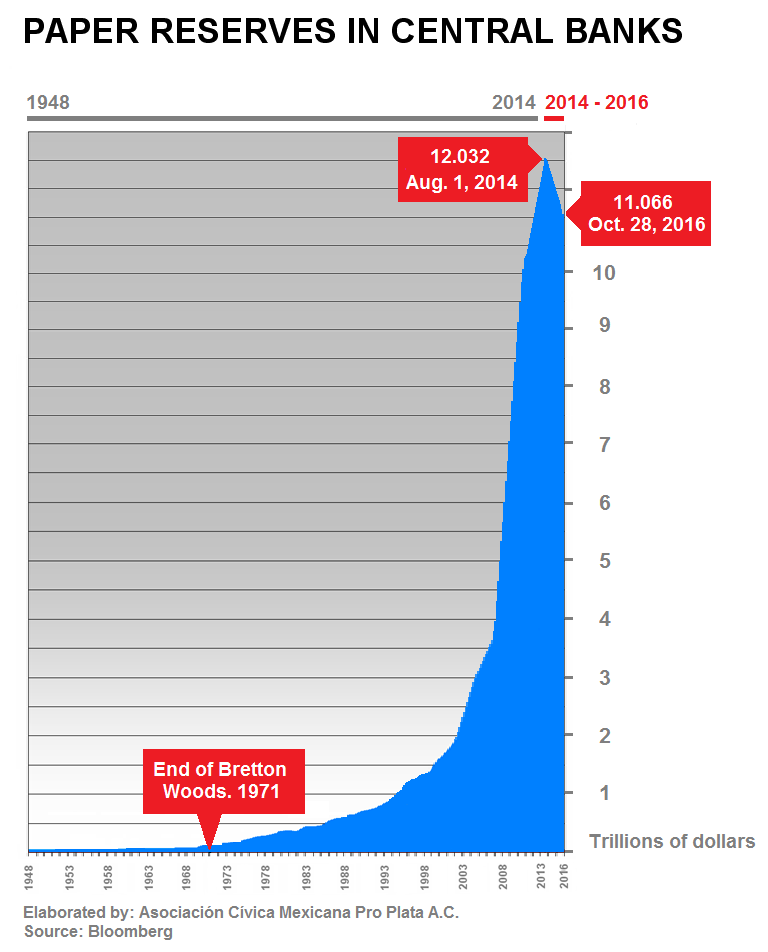

Now, take a look at this graphic which I nicked from Hugo Salinas:

Betting against the ability of governments and their central banks to keep holding the proverbial glass of water has been a losing proposition for a looooong time.

Now, simple math tells us that although this debt growth is pretty damned fantastic it needn’t be a problem if income growth has kept up with it. Income, after all, services debt.

Since income growth hasn’t kept up clearly that’s not the case. So what is it?

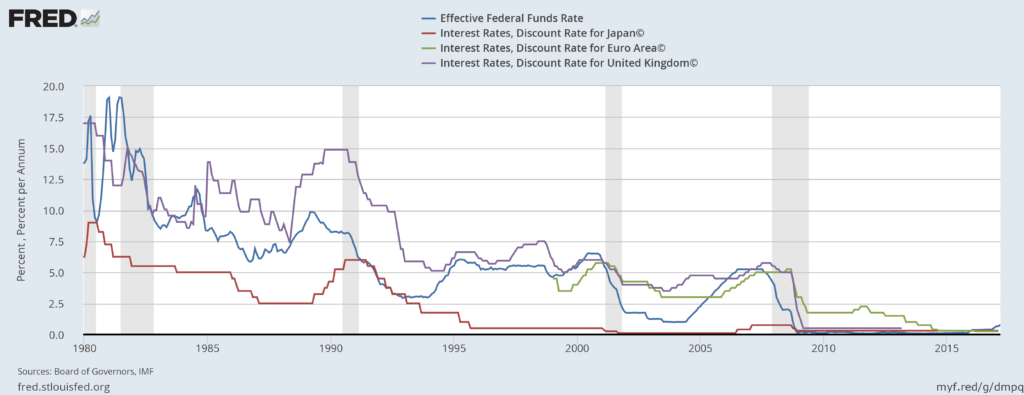

The answer lies in this chart which shows the cost of capital across the major economies of the US, the EU, the UK, and Japan.

When the cost of debt servicing is low or zero, then the size of debt really doesn’t matter much. It’s as if the glass of water has no weight at all.

Now here’s something worth pondering…

On an historical timeframe we’re at the tail end of the long term debt-cycle… a cycle that typically lasts between 50 and 75 years.

Today, bonds are more sensitive to price movements than at any other time in history and the yield achieved on them so low that it doesn’t take all that much for a positive return (just) to turn into a loss.

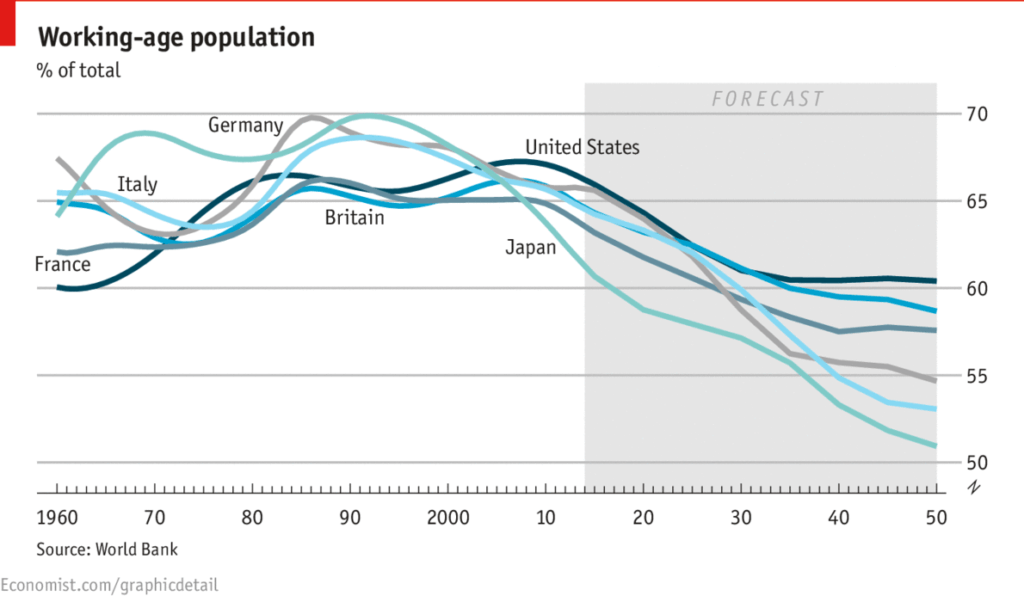

Now take a look at this:

Poor old Clyde and Maureen have been having one “heckuva” time achieving any returns at all but what they absolutely can’t afford to do is lose money as they move into their “golden years”. Bonds, especially government bonds, provide “certainty” for them.

Leave A Comment