It’s pile on time when it comes to Wall Street telling you why you should prefer pretty much any equity market in the world to US stocks.

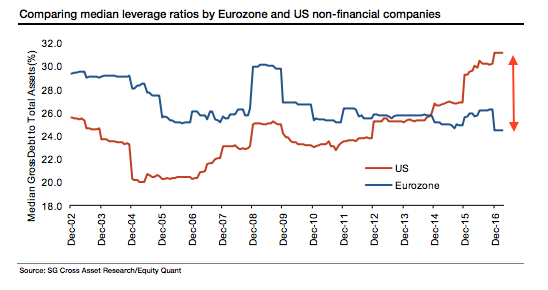

To be sure, that’s not necessarily meant to be disparaging towards the people churning out this research. All you have to do is look at your favorite multiple and/or take a peek at corporate leverage to understand that nothing is cheap and/or safe state-side. Indeed, we highlighted a note out from SocGen that discussed this very same topic earlier today. Here’s one of the more disconcerting visuals from the bank’s Andrew Lapthorne:

Well on Wednesday afternoon, it’s Goldman’s turn. Specifically, the Squid sent Peter Oppenheimer, Christian Mueller-Glissmann, and Ian Wright (who together are pretty good at what they do) out to find “10 reasons to buy Europe & EAFE relative to the US.”

It’s past the closing bell on the east coast which means most people have already decided to stop thinking for the day, so rather than run through the entire list, how about one easy chart?

Or, put differently, if you want a reason to prefer overseas equities to their US counterparts, how about this: there’s no way this can possibly continue ad infinitum…

Since the start of the financial crisis, the S&P 500 has outperformed the MSCI EAFE by 37% and the Stoxx 600 by 33% (all in total returns in $). But the long-term downtrend of relative performance between the EAFE and the S&P 500 now appears to have ended.

Leave A Comment