Question: What do you call an asset that appreciates 5,555,456% in a little over 7 years?

Answer: Bitcoin.

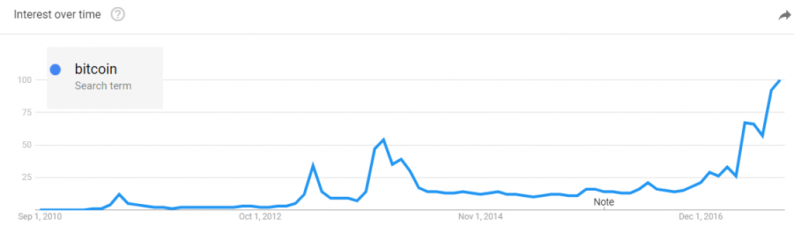

In 2010, when Bitcoin was trading at $.09 that word meant nothing to most investors. Earlier this month when it crossed above $5,000, it was all investors wanted to talk about.

What changed? The price. It went up, and up, and up.

The thought of turning $10,000 into over $555 million is, needless to say, enticing to some.

As is the thought of owning something that seems to hit a new all-time high milestone nearly every day.

At a certain point, the fear of missing out (FOMO) becomes palpable: many simply can’t stand seeing Bitcoin go up any longer.

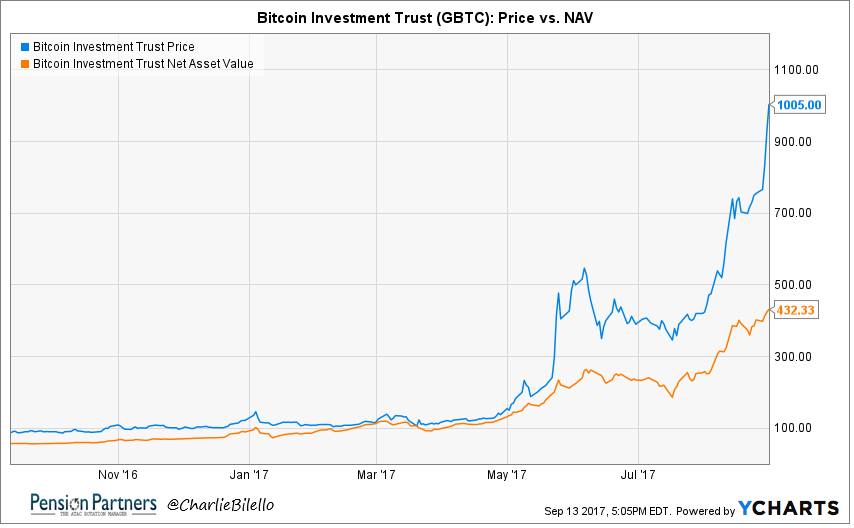

How do I know this is true? In late August, investors in the “Bitcoin Investment Trust” were paying $1,005 for Bitcoin assets worth $432, an incredible 132% premium to NAV. Why would a rational investor pay such a hefty premium? Simple: they think they will sell it to someone else at an even higher price. Who said investors were rational?

Leaving aside whether FOMO is good reason to invest in something, what was the risk tolerance of an investor buying into Bitcoin at $5,000? In plain English: how much Bitcoin were they willing and able lose?

A simple question with a not-so-simple answer, especially after an asset class has gone parabolic. We tend to become blinded by such astronomical gains, failing to remember the risk part of the risk/return equation.

I know, I know, Bitcoin never seems goes down. It is the currency of the future. Why worry about risk in an asset that only goes in one direction?

Just humor me for a minute, and try to imagine a world in which Bitcoin drops 39%, 85%, or 94%.

Sounds crazy, I know. But you’ll notice in the table below that this is not a theoretical exercise. In 2011, it went from $32 to $2 in the span of 5 months, declining 94%. From late 2013 to early 2015, it went from 1,166 to $170, an 85% decline. And as recently as June to July of this year, it dropped 39% ($3,025 to $1,837).

Leave A Comment