Alas, fakery isn’t actually a solution to fiscal/financial crisis..

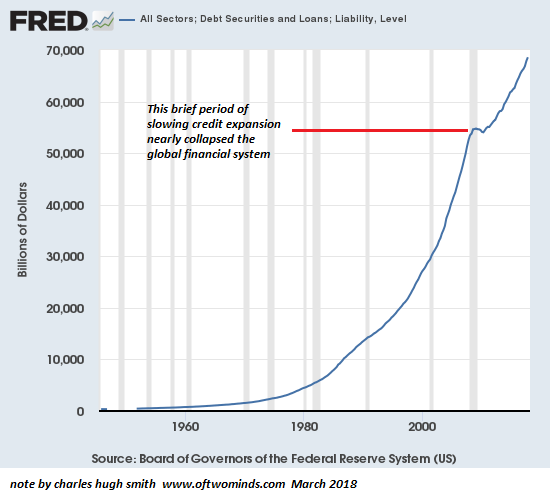

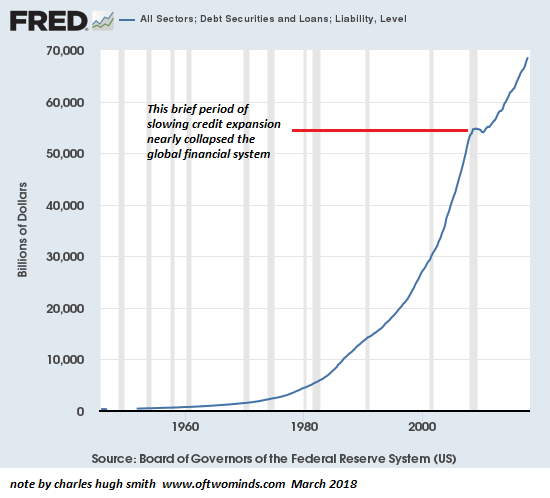

This chart of “debt securities and loans”–i.e. total debt in the U.S. economy–is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or “emitting” in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the magical air of fractional reserve banking.

Central banks also create new currency at will, and emitting newly created money is how they’ve bought $21 trillion in assets such as bonds, mortgages, and stocks since 2009. Is there an easier way to push asset valuations higher than creating “money” out of thin air and using it to buy assets, regardless of the price? If there is an easier way, I haven’t heard of it.

Which brings us to the question: how much longer can we get away with this travesty of a mockery of a sham? How much longer can we get away with creating “money” by issuing new debt/liabilities to grease the consumption of more goods and services and the purchases of epic bubble-valuation assets?

Since humans are still using Wetware 1.0 (a.k.a. human nature), we can constructively refer to the Roman Empire’s experience with creating “money” with no intrinsic value. The reason why the Roman Empire (Western and Eastern) attracts such attention is 1) we have a fair amount of documentation for the period, something we don’t have for other successful empires such as the Incas, and 2) we’re fascinated by the decline and collapse of the Western Empire, a structure so vast and successful that collapse seemed impossible just a few decades before the final unraveling.

One of the books I’m currently enjoying is The Fate of Rome: Climate, Disease, and the End of an Empire, a new exploration of the impact of climate change and pandemics on the Roman Empire’s final few centuries.

Leave A Comment