I’d been asked several times this past week about a mid-cap biotech concern called Isis Pharmaceuticals (NASDAQ:ISIS). The company is on the move due to its evolving pipeline, key partnerships and potential as an acquisition target. Although I think M&A activity in the biotech sector will remain robust for myriad reasons over the next year, we will concentrate our analysis on the company’s evolving pipeline and numerous partnership with larger players in the industry. Despite its unfortunate name, the investment case on ISIS is intriguing.

Company Overview:

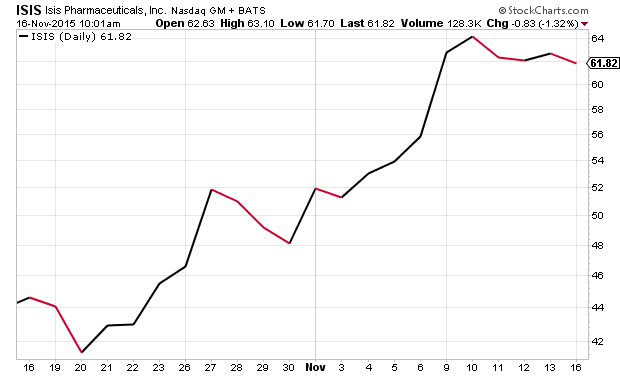

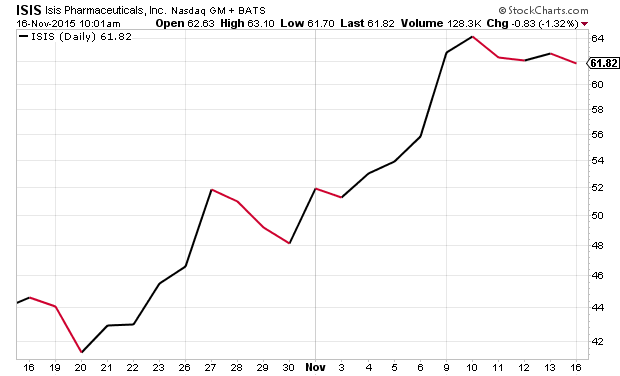

Isis Pharmaceuticals develops antisense therapies aimed at severe or rare cardiovascular, metabolic and cancerous conditions. It has commercialized only one drug, Kynamro, which it has licensed to Genzyme. Sales have been limited due in part to side effects related to liver function. The company has 38 drugs in various stages of development, however, as well as strong partnerships with many large pharmaceutical companies. The company has a market capitalization of approximately $7.5 billion and trades at just over $62.00 a share after a ~50% run up over the past month.

Antisense Technology

RNA molecules are the targets of antisense drugs. RNA affects gene expression. It is a simpler molecule than protein because it has four fundamental building blocks (nucleotides A, C, U & G) whereas proteins have twenty (amino acids).

Antisense drugs bind to RNAs that encode protein and inhibit the production of proteins that cause disease.

Deep Pipeline, Multiple Shots on Goal

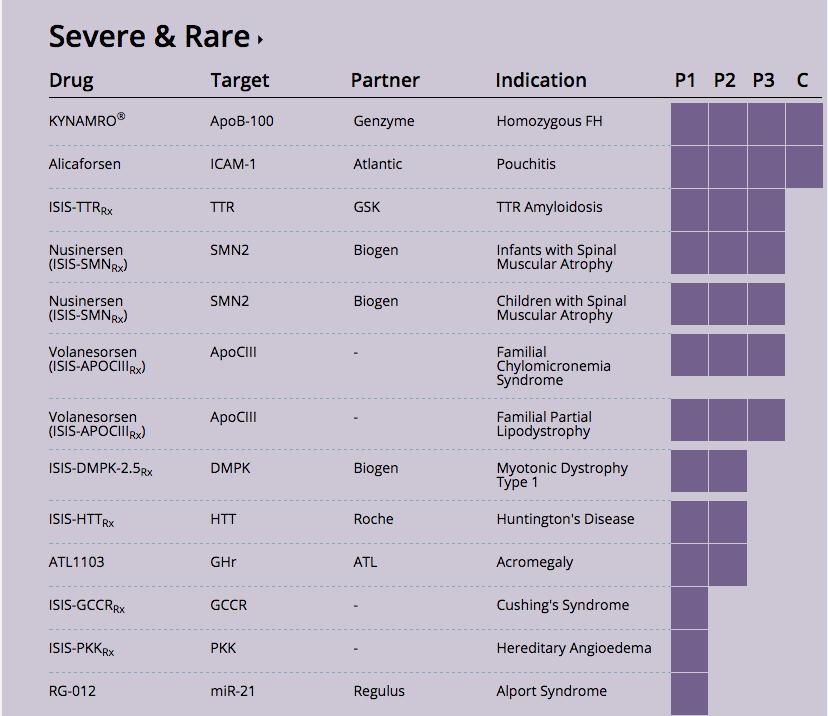

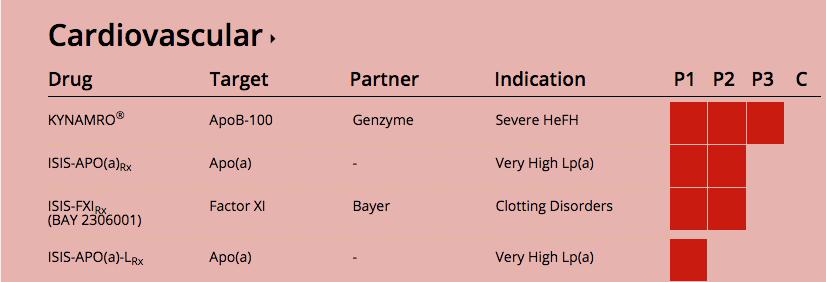

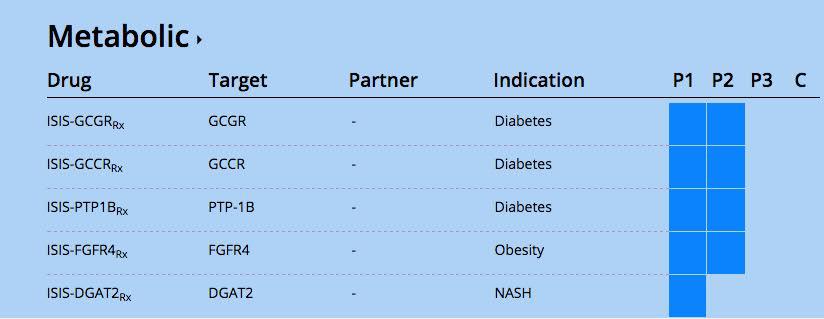

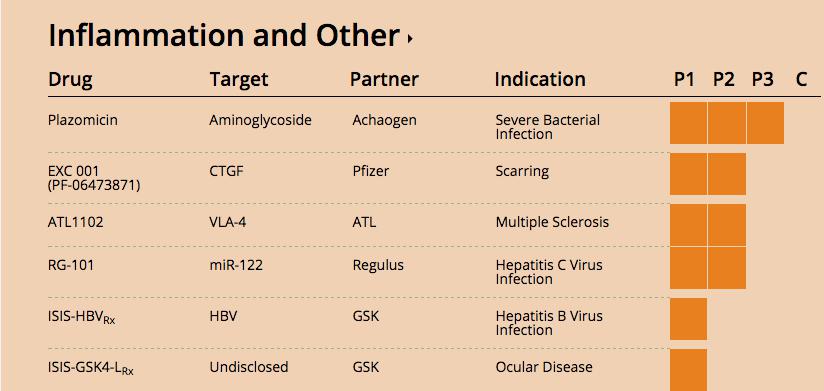

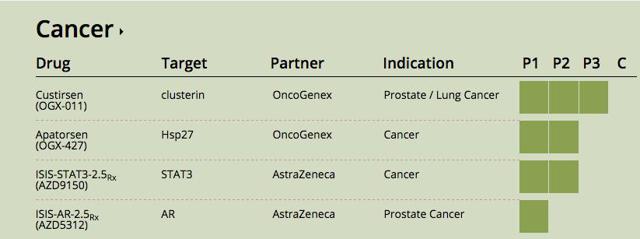

With 38 drugs in development and more to come, it is reasonable to expect ISIS will get some hits. In a sense, owning ISIS stock is a microcosmic version of my shotgun approach to biotech investing… albeit with concentrated management risk. The charts below show the various candidates Isis is developing:

Partnerships with Major Players

As we can see from the charts above, Isis has partnerships with many large pharmaceutical players. Here is a taste of its collaborative programs:

Leave A Comment