<< Part I: How the Asset Bubble Could End

Contradictory Signals

Special antennae that help traders catch upcoming opportunities. Available from the same outfit that sells the soup-cooling spoon (Acme Inc).

There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is that margin debt normally peaks well before the market does. Based on this indicator, one should not expect major upheaval anytime soon. There are exceptions to the rule though – see the caption below the chart.

A new all-time high in NYSE margin debt: this is in line with the other indicators shown here, and normally margin debt tends to peak before the market does. This is generally true – but not always. We found two major market peaks – namely the 1937 and 1973 tops – when margin debt peaked after the market had topped out. In 1937 it happened just one month after the top, in 1973 it happened 8 months after the top. Note also that at the 1937 market peak, there was no warning from the NYSE advance-decline line either – it topped almost concurrently with prices – click to enlarge.

Since we discussed bubble blow-offs earlier this year (see: Speculative Blow-Offs in Stock Markets, Part 1 and Part 2), we have pointed out several times that an unusual number of diverging signals could be observed this year. And many signals we would normally expect to have appeared on the horizon by now are simply not in sight yet.

Consider for instance this chart from Moody’s, which we showed in one of our articles on credit spreads. It depicts debt as a percentage of internal company funds compared to actual and expected default rates. It is logical that these tend to be highly correlated, and yet, they are suddenly diverging rather noticeably.

Similarly, current market valuations and sentiment/positioning data are at such rare extremes that we would normally expect to see a number of “confirming signals” elsewhere by now – but that is not the case.

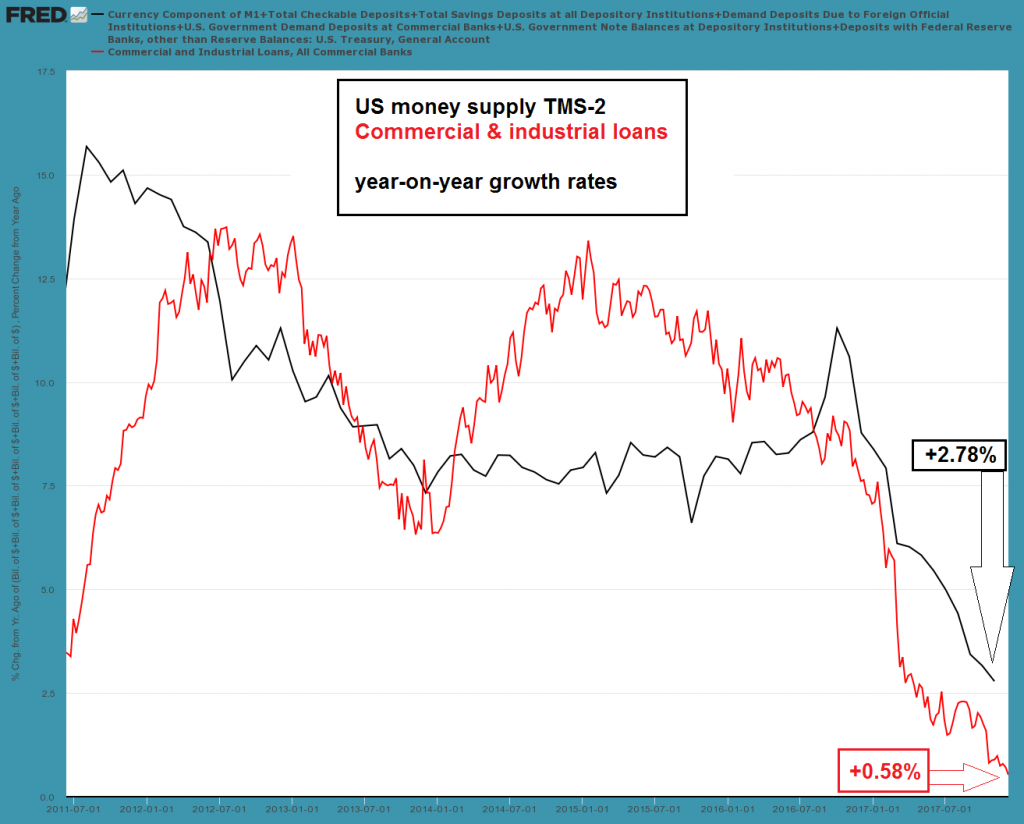

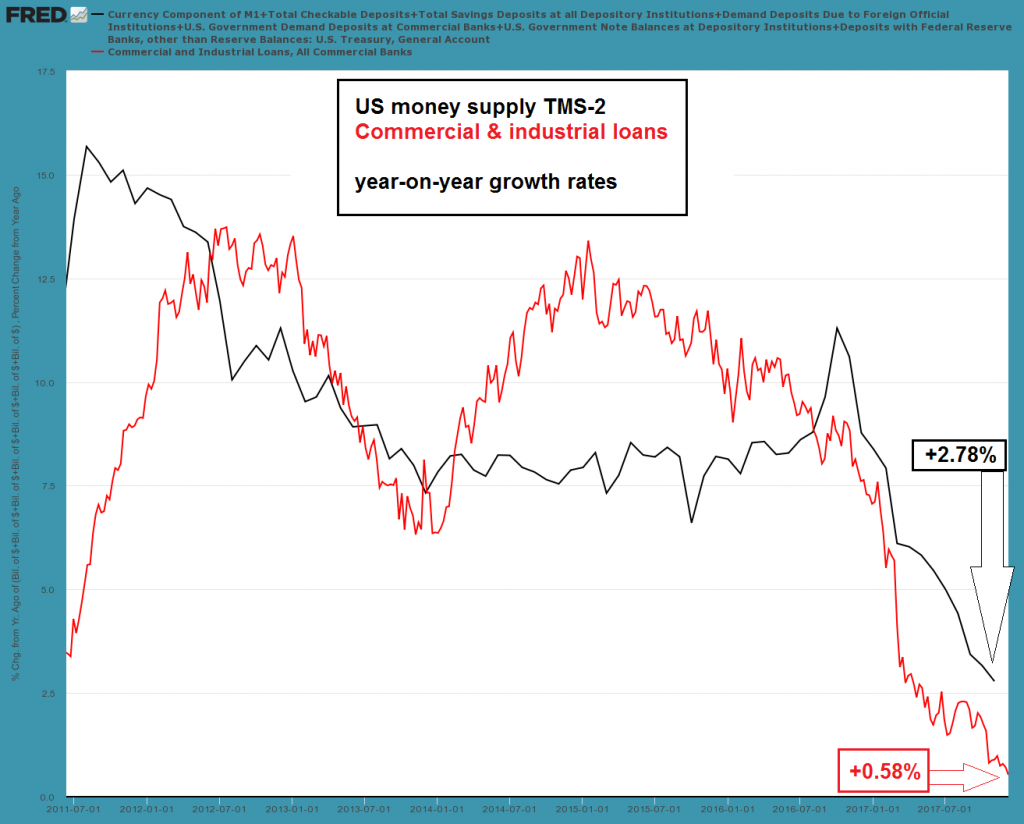

The sharp decline in broad true money supply growth continues as well. The latest update shows that y/y TMS-2 growth has fallen to just 2.78% in November, while commercial and industrial loan growth is barely clinging to positive territory:

US money supply growth continues to tank rapidly – down another 38 basis points from the October level to just 2.78%, the lowest reading since April 2007. C&I lending growth has fallen again this week, the latest reading is actually even lower at 0.52% – click to enlarge.

Valuations, sentiment data and money supply growth all suggest that the bubble should be on its last legs, or should at least be close to a major “correction”. However, if we look at the yield curve, it is still flattening – no significant reversal toward steepening has occurred yet (admittedly the recent speed of flattening can be seen as a kind of “Nimzovich threat”. Nimzovich once described a chess move as follows: “We aren’t threatening anything here. We are only threatening to threaten.”).

10 year minus 2 year spread: no sharp upside reversal is in sight yet, but the speed with which it is flattening is noteworthy – click to enlarge.

Also, none of the other early recession warning signals we usually see in economic data are in evidence: initial unemployment claims just made new lows at around 225K, ISM numbers are hovering near the top of their historical range (the manufacturing ISM is above 58 points) and real gross domestic private investment just hit a new record high. All of these normally tend to visibly deteriorate prior to recessions.

Lastly, market internals have not deteriorated to an overly alarming extent either. There is definitely some deterioration, which can e.g. be seen in the high density of “Hindenburg signals” given over the past year. However, the A/D line is at a new high, the percentage of stocks above their 50- and 200-day moving averages has recovered smartly, and our new highs/new lows percent indicator also continues to behave well (this one proved particularly useful in warning of corrections in recent years).

Leave A Comment