In any valuation of common stock, estimating the growth rate is a key factor. It seems that every possible formula for determining a company’s intrinsic value relies heavily on a growth variable. As such, intelligent investors must place great emphasis on utilizing an effective and reliable method of estimating growth.

In this article we will explore various approaches to estimating growth, providing examples of each, and then explain the ModernGraham approach to the problem of growth rates.

Analyst Estimates

The easiest way to select a growth rate for a company is to utilize the analyst estimates. Analysts will regularly provide estimates for earnings growth over the next five years. For example, here is a screenshot from Yahoo Finance’s Analyst Estimates page for Microsoft Corporation (MSFT):

As you can see, Yahoo Finance has provided an aggregate growth estimate for Microsoft of 7.2% per year for the next five years. Also shown for reference purposes are the annual growth rate over the last five years, and current figures.

Using the analyst estimates can be very easy and quick, so it might be a possible approach for Defensive Investors, those who are not willing to spend much time conducting research, but it does have some limitations. Analysts are often wrong when estimating earnings, as evidenced by the next image showing the recent quarterly earnings results compared to the analyst estimates (taken from the same page as the last image):

So, you can see that using an analyst estimate for growth may be simple but it could be inaccurate. Given that you do not know the assumptions that went into the analyst’s estimate, it may be better to make your own assumptions and calculations. After all, you may end up being just as inaccurate as the analysts, but at the very least you will understand what went into the equation.

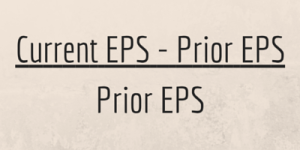

Basic formula for growth

The first step in estimating a growth rate is to understand the basic formula for calculating a growth rate. In simple math, a growth rate is calculated by taking the change in figures divided by the original figure. In other words:

If that wasn’t clear, then let’s go back to Microsoft. Based on the financial statements listed on GuruFocus, Microsoft’s EPS for 2013 was $2.58 and for 2012 it was $2.00. So, to calculate the basic growth rate from 2012 to 2013, you should take $2.58 – $2.00, which equals $0.58, and divide that by $2.00. The result is a growth rate of 29%.

Average growth over a period of time

There are limitations to using a growth rate for any given year, though. Continuing our Microsoft example, the company’s EPS in 2014 was $2.63, so the growth rate was only ($2.63 – $2.58) / $2.58 = 1.9%. Going further, in 2015 the company’s EPS was only $1.48 so the growth rate was negative: ($1.48 – $2.63) / $2.63 = -43.7%. So over the last three years, Microsoft’s annual earnings have been:

Clearly there can be great fluctuation in growth from year to year, so how do you smooth that out in order to get a good estimate for the future? By using an average growth rate over a period of time. There are a few different ways to accomplish this, and we’ll start with the basic average.

Leave A Comment