TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

InfoSonics (IFON) has been a perennial net net stock since the 08? recession. I’ve held it before and every 2-3 years it would come back on my radar as it jumps and sinks below the net net equator.

IFON net net stock status activity

Currently IFON is sitting on a market cap of $9M.

The important question is whether IFON is cheap enough to buy after the 15% drop. Allow me to work through the company and numbers and you’ll get my answer at the bottom.

As it stands, InfoSonics is a micro cap with a Net Current Asset Value of $10.1M.

For net net type stocks like InfoSonics, I don’t pay much attention to the product and business model. My method is to make sure the balance sheet is healthy and not burning cash.

It is to protect the downside.

However, if you’re new to the InfoSonics name, they sell phone cases, budget mobiles and tablets under the “verykool” brand… which isn’t very “kool” at all.

They look to be keeping up with market trends which is a plus, because many failing net nets tend to have outdated business models, throw away money or sit on an empty cash box twiddling their thumbs.

What is the Net Net Calculation?

With any cheap stock, the balance sheet will make or break the investment. Any net net can be a screaming deal, provided the balance sheet gives you a margin of safety.

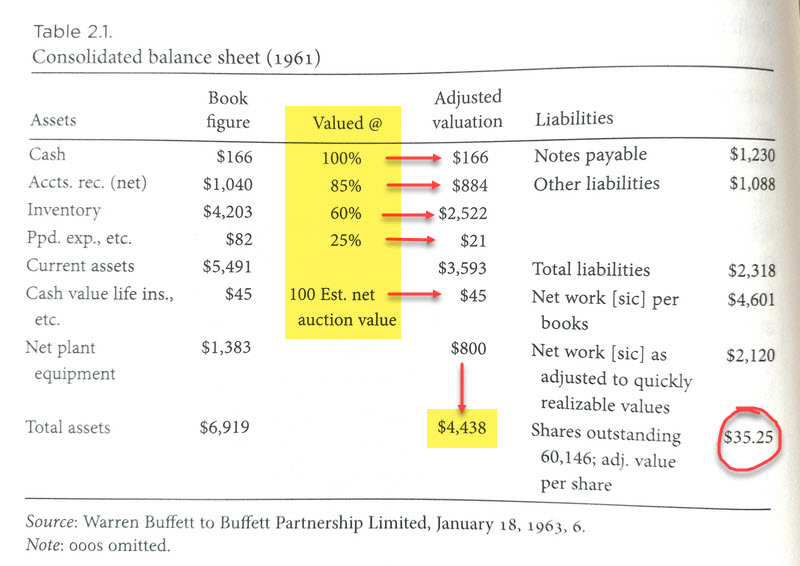

In 1963, Buffett drew up a table for his thesis on Dempster Mill at the time he began his investment in 1961.

Buffett’s Net Net Working Capital Calculation for Dempster Mill

Buffett owned a littler over 70% of Dempster Mill at the time, so he was able to replace management to increase the value of the balance sheet, expand his margin of safety and come out with a profit.

Leave A Comment