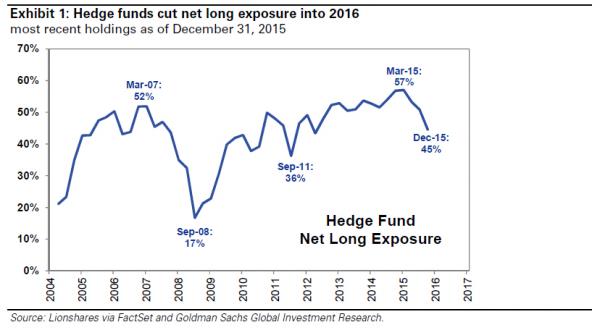

It has been a bad year for most markets. It has also been a bad year for those entities who collect 2 and 20 to “hedge” against bad years for markets: hedge funds. Unfortunately, as we have said since 2009, most hedge funds tend do anything but actually “hedge” which is why as Goldman’s latest HF tracker reports, hedge funds have only modestly outperformed a weak S&P 500 (SPY) YTD following their reduction in net long exposure to 45% at the start of 2016, the lowest level since 2012. Most are down for the year.

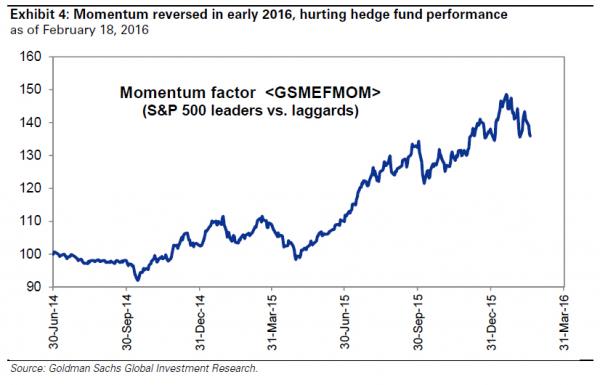

The reason for this underperformance is that the most popular positions continued to suffer as the reversal in momentum hurt highly concentrated hedge fund portfolios. The average fund holds 68% of long assets in its top 10 positions, most of which happen to be momentum driven. Perhaps instead of “hedge funds” they should be called “momentum funds”?

Some further observations from David Kostin:

Despite reduced risk-taking at the start of 2016, the momentum reversal in January hurt heavily concentrated hedge fund portfolios, prompting further de-risking and contributing to a vicious cycle that compounded the underperformance of the most popular hedge fund positions. Momentum (the continued outperformance of past leaders) was a powerful trend in 2015, rising roughly 50% from May until its sharp reversal in mid-January (see Exhibit 4). As momentum reversed, our Hedge Fund VIP list of the most popular hedge fund long positions also lagged. The basket (ticker: GSTHHVIP) has underperformed the S&P 500 by 386 bp YTD (-10% vs. -6%).

As a reminder, Goldman is now trying to make its Hedge Fund VIP basket into an ETF in an effort to make it easier for underwater HFs to offload exposure to retail investors as few other hedge funds, most of whom are already in the same positions, have any interest. Some more observations on said basket:

Our hedge fund VIP list (Bloomberg ticker: ) consists of stocks in which fundamentally-driven hedge funds have a large position. We define stocks that “matter most” as the positions that appear most frequently among the top 10 holdings within hedge fund portfolios. For this analysis, we limit our universe to hedge funds with 10 to 200 distinct equity positions in an attempt to isolate fundamentally-driven investors from quantitative funds or funds that mirror private equity investments.

Leave A Comment