The biggest movers on FOMC days are the Dollar Index, Investment-grade credit, Homebuilders and Real Estate, according to Goldman Sachs’ options strategists.

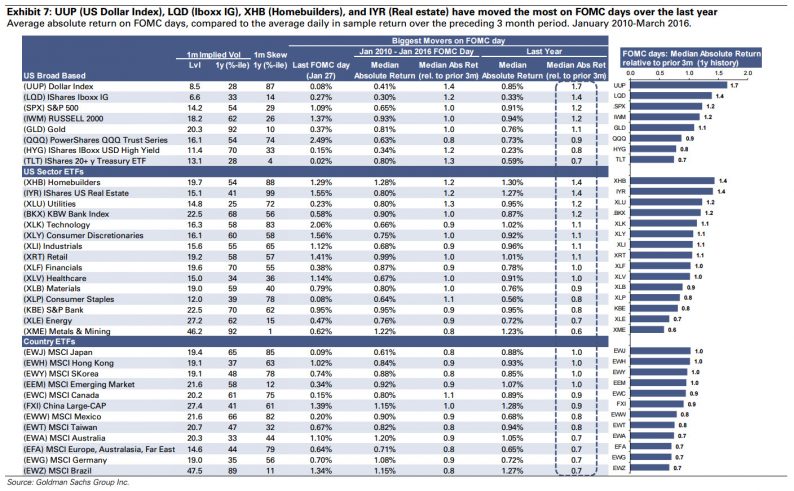

We analyze the median 1-day moves on FOMC release days across broad based US equity indices, sectors, and country ETFs over the last year, and also back to January 2010, to rank the assets by their sensitivity to Fed’s announcements. To this end, we take absolute values of 1-day returns on the day of FOMC announcements, and scale them by average 1-day absolute returns over the preceding 3-month period in order to control for a prevailing level of market volatility. Next, we look for a median move within a period of interest – last year, or since January of 2010 – to identify assets that, on average, have moved the most (in either direction, due to the use of absolute returns), and thus are likely to be the assets that have been the most sensitive to Fed’s announcements over the period of interest(see Exhibit 7).

UUP, LQD move the most on FOMC days. Among broad-based US indices, the largest relative moves were registered by UUP (PowerShares DB US Dollar Index Bullish Fund) and LQD (IShares Iboxx Investment Grade Corporate Bond ETF), both over the last year and over the longer time period. In particular, the Dollar index’s median return over the last year was 70% higher than average (in absolute terms) following FOMC announcements.

Homebuilders, Real Estate the most sensitive sectors on FOMC days. Among sectors, the homebuilders and real estate sectors have been the leading Fed watchers, followed by Utilities and Banks, likely due to their inherent strong leverage to the level of financial conditions, and, by implication, Fed’s policy. On the opposite end are Metals & Mining and Energy sectors, where other drivers appear to trump the sensitivity to Fed policy shifts.

Japan, EM sensitive to FOMC, Europe less so. The top mover on FOMC days among country ETFs is Japans , likely due to heightened leverage of Japanese equities to financial conditions. But right behind Japan is a group of EM-themed ETFs, suggesting that the Fed’s policy figures aa prominent driver of EM equity returns. On the other end of the country ETF spectrum is a group of ETFs with strong European leverages.

Leave A Comment