Buying GBP/USD scenario

If it comes out at higher than expected with a deviation of +0,85 or higher, the pair may go up reaching a range of 46 pips in the first 15 minutes and 90 pips in the following 4 hours.

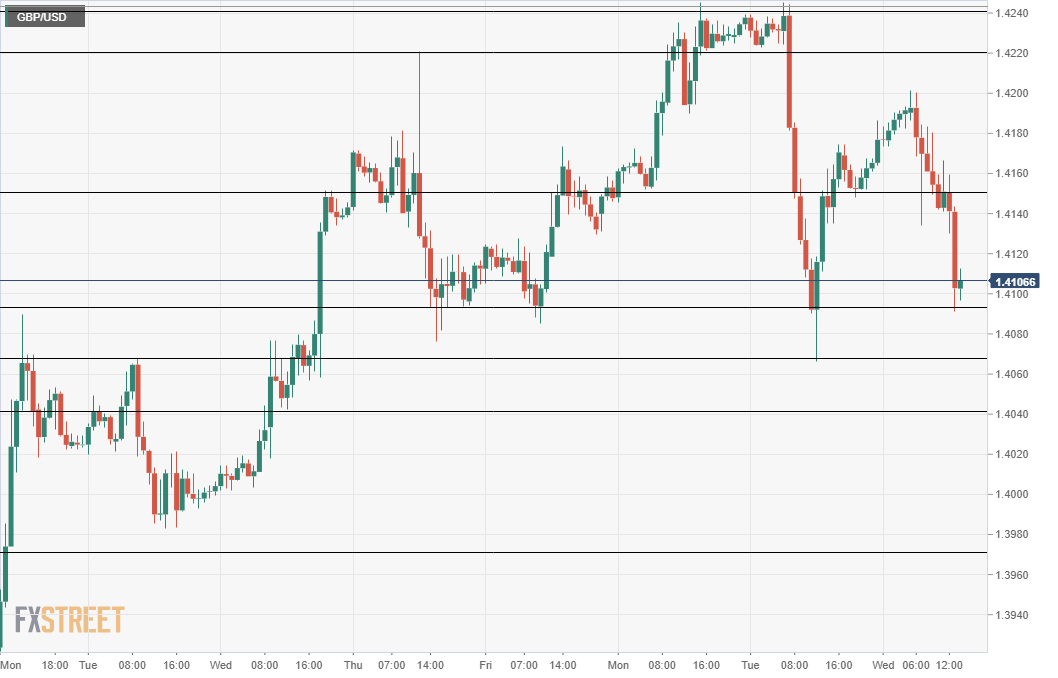

On the upside, there are clusters of resistance at 1.4150 and 1.4225.

From a positioning perspective, supply is noted at 1.4194 and above 1.4240.

Selling GBP/USD scenario

If it comes out lower than expected at a deviation of -0.48 or less, the GBP/USD may down up reaching a range of 32 pips in the first 15 minutes and 74 pips in the following 4 hours.

Support levels are to be found approximately at 1.4066 and 1.3970accordingly to the Confluence Indicator

Vestiges of demand can be seen around 1.4075 and below at .1.4040, based on aggregated trading positions from FXStreet’s dedicated contributors

GBP/USD Levels on the chart

No less than 81% of GBP-based pairs are in bullish mode against a basket of 20 world currencies accordingly to the GBP-Bullish Percentage Index. As such, a release which surprises the market with a negative trigger (GBP positive) may lead to a stronger down move in the GBP/USD.

How UK GDP previously moved the GBP/USD

In the last five releases, the GBP/USD moved, on average, 38 pips in the 15 minutes after the release and 71 pips in the 4 hours after the announcement.

The previous release had a surprise of -0.74 regarding deviation, and the GBP/USD reached a range of 60 pips in the first 15 minutes and 72 pips in the following 4 hours.

Leave A Comment