Photo Credit: Mike Mozart

VeriFone Systems, Inc. (PAY) Information Technology – IT Services| Reports March 10, After Market Closes

Key Takeaways

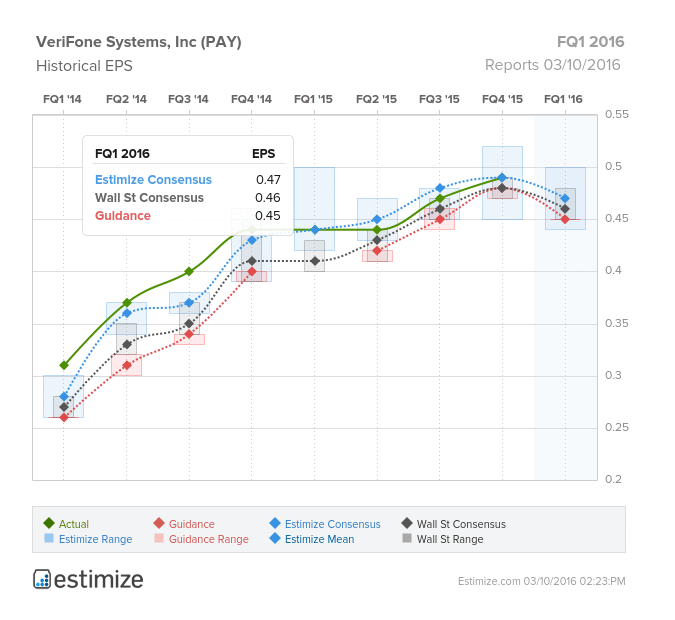

Payment solutions company, VeriFone, is scheduled to reports fiscal first quarter 2016 earnings today after the market closes. Last quarter the company delivered a 12.5% earnings surprise, with revenues increasing 4.8% on a YoY basis. Historically, Verifone beats Wall Street 80% of the time while only trumping the Estimize consensus in 50% of reported quarters. The Estimize community is calling for EPS of $0.47 and revenue expectations of $502.82, 1 cent higher than Wall Street’s earnings estimate and $2.5 million greater on the top line. This predicts a favorable increase compared to the year prior with earnings increasing 7% and sales expected to grow 3%. VeriFone’s sizeable position in electronic payment systems and global dominance in EMV platforms is expected to bode well coming into its quarterly earnings.

Currently, VeriFone has a dominant position in the electronic payments space with around 30 million system terminals globally. The company has led the migration towards more secure EMV chip compatible equipment and now provides more than 50% of the world’s EMV terminals. VeriFone sees this number growing by 30% after the mass adoption from merchants to install EMV capable terminals this past October. This enables VeriFone not only to participate in the changing payments landscape but it will also generate higher demand and in turn profit and sales growth. Moreover, the payment company has successfully leveraged new acquisitions into significant growth. In the last completed quarter VeriFone acquired Curb and InterCard AG which will help expand its presence across Europe.

Leave A Comment