Photo Credit: Fred Seibert

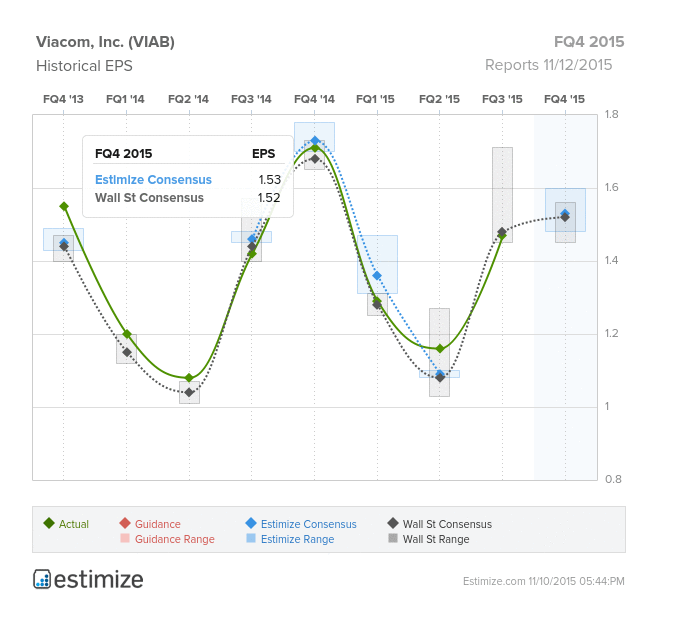

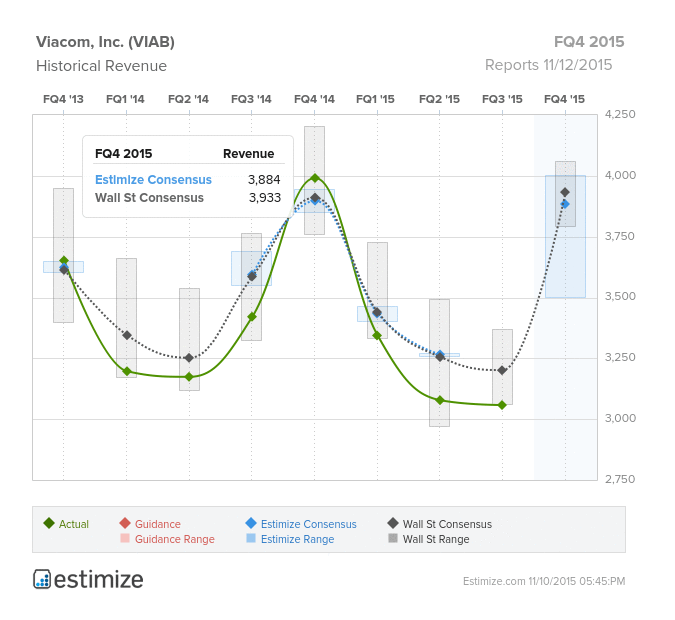

Viacom, a global media conglomerate that owns brands like MTV, VH1, Nickelodeon, and Comedy Central, will be reporting 4Q2015 earnings before the market opens on Thursday. Last week, Time Warner Inc. lowered its profit guidance, causing a hullaballoo amongst media companies. Viacom shares fell 6.6%, as cord-cutting concerns continue to be a reality. Factoring in lower cable revenues and other headwinds, the Estimize group is presuming EPS of $1.53 and revenue of $3.88 billion, surprisingly lower than Wall Street analyst estimates of $1.54 EPS and revenue of $3.93 billion.

Though Viacom’s main source of revenue is from cable networks, declining cable revenues and cord-cutting will only be a temporary setback. The firm is working feverishly to find new streams of revenue and is assertively exploring the digital space.

In late October, the company became a major minority stakeholder in DigiTour Media, a business that holds large-scale festivals and events with social media stars. Viacom will also have a place on the board of directors.

In addition with DigiTour, separate contracts were finalized with e-commerce powerhouse Amazon and multinational corporation, Sony. The provisions of the Amazon deal include the wide circulation of Viacom-owned programming on Amazon Prime, although they recently decided to drop many of Viacom’s shows as viewers become fatigued with reality TV. The agreement with Sony is revolutionary as it may be the future of television platforms. Sony has been working and developing an Internet television service to combat cable companies and attract cord-cutters. The service will carry Viacom-owned channels and both companies will be spearheading the campaign against cable and dish programming.

VIAB data by YCharts

The New York City based group has also tapped into the likes of TiVo. Both firms have entered into a partnership that allows for the entertainment company to utilize TiVo box user data to help advertisers place more strategic commercials on the Viacom networks. This deal comes shortly after the relinquishment of Viacom Vantage, Viacom’s in-house attempt at helping the advertising firms target specific consumers.

Leave A Comment