I guess this is as good a time as any to talk about yields – again.

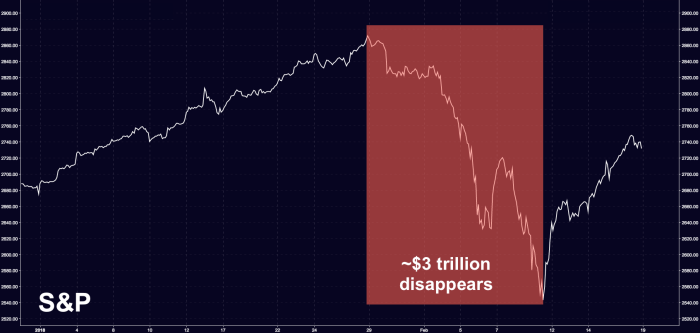

Although most investors are undoubtedly aware, in hindsight, of the role rising Treasury yields played in setting the stage for the turmoil that rocked markets earlier this month and erased some $3 trillion in value, it’s not at all clear that everyone has a solid grasp why this suddenly became a problem.

After all, it’s not as if yields weren’t already rising. But it is readily apparent that a whole lot of market participants were not prepared for the sudden shift in the narrative around those rising yields. Indeed, it’s not at all clear that the vast majority of market participants understood what the original narrative was or that narratives even mattered in the first place.

You can tell a lot of people had no conception of that because some $40 billion was plowed into U.S. equity funds in January just as the bond rout was accelerating.

Walter White@heisenbergrpt

Walter White@heisenbergrpt

pour out a little of your 40 oz. for the people who poured $40 billion into U.S. equity funds last month.

5:30 PM – Feb 8, 2018

- 4

-

Walter White@heisenbergrpt

Walter White@heisenbergrpt

That acceleration in the bond selloff led to some of the worst risk-adjusted returns for 10Y U.S. Treasurys on record and it was abundantly clear to those who understood the backdrop that the narrative was rapidly shifting and that the rapidity of rate rise was likely to flip the stock-bond return correlation positive in fairly short order.

Given anecdotal evidence that suggested at least some of the money that flooded into U.S. equities to start the year came courtesy of retail investors (E*Trade added 64,581 gross new brokerage accounts in January, the most for a single month since September of 2016, for instance), it wasn’t hard to predict that a lot of the $40 billion highlighted in the chart above would likely come pouring right back out at the first sign of trouble, which is exactly what ended up happening.

Leave A Comment