Moments ago IBM reported what can be defined simply as abysmal results.

Starting at the bottom, non-GAAP EPS of $3.34 beat expectations of $3.30 but once again thanks to the same trick the company used two quarters ago: it again reduced its effective tax rate from continuing operations down to 18.2%, 2.6% lower than a year ago. Without this reduction, and the $1.5 billion in stock buybacks, non-GAAP EPS would have missed. In fact, a simple math exercise shows that if instead of the pro-forma 18.0% tax rate, IBM had used the 20.6% from a year ago, its non-GAAP EPS would be $3.23, missing consensus.

As for the GAAP bottom line, IBM’s income from cont ops of $3 billion was 14.3% lower than a year ago.

Oddly while the company was quick to blame the soaring USD for its earnings debacle, a dollar whose direction even the most inexperienced CFO could and should have hedged months ago, there is little discussion of why IBM is engaging in such petty gimmickry.

And speaking of everyone blaming FX on their woeful results, just think of how much higher the net income of the S&P would be if US CFOs repurchased one less share and instead splurged the $170 to buy “Hedging Currency Exposures: Currency Risk Management” – a book which apparently nobody in senior management has ever read.

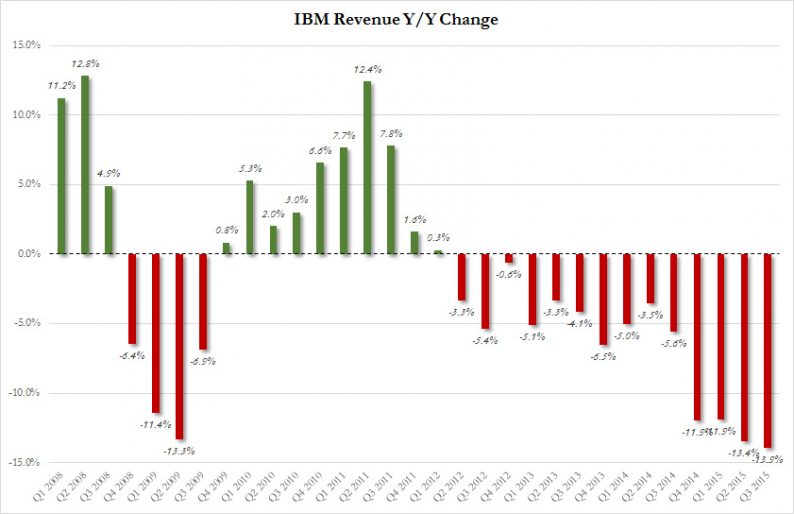

Yet nowhere was the collapse in IBM’s business more evident than in the top-line, where IBM’s revenues of $19.3 billion, which missed expectations by a whopping $300 million, were down a massive 13.9% from a year ago, worse than the 13.3% plunge recorded in the Lehman quarter…

Click on image to enlarge

… and the lowest quarterly revenue since Q1 of 2002.

Click on image to enlarge

Operationally, things are only going to get worse, because not only did IBM report ugly Q3 earnings, but it also slashed guidance as follows:

IBM expects full-year 2015 GAAP diluted earnings per share of $13.25 to $14.25, and operating (non-GAAP) diluted earnings per share of $14.75 to $15.75. IBM expects free cash flow to be relatively flat year-to-year. The 2015 operating (non-GAAP) earnings expectation excludes $1.50 per share of charges for amortization of purchased intangible assets, other acquisition-related charges and retirement-related charges.

Leave A Comment