As most of you know, I believe the market is currently in a long term down trend. However, I’m starting to see things that put the bear market in doubt… which should be a really good sign that we’re still in a down trend — because bear market rallies create enough doubt to suck people in. Back to the point, take a look at the chart below. It is a point and figure chart of the S&P 500 Index (SPX). This chart shows an intermediate or short term up trend within the confines of a longer term downtrend. But a closer look at the short scale indicates a long term sideways range. It will take a break of the range to add clarity to the pattern.

A daily chart of SPX has a fairly clear downtrend channel. This indicates a new bear market is underway. We have to consider the current rally as a bear market rally until the upper bound of the trend channel is broken. If that channel is broken then the pattern will look like a long consolidation during the course of an ongoing bull market.

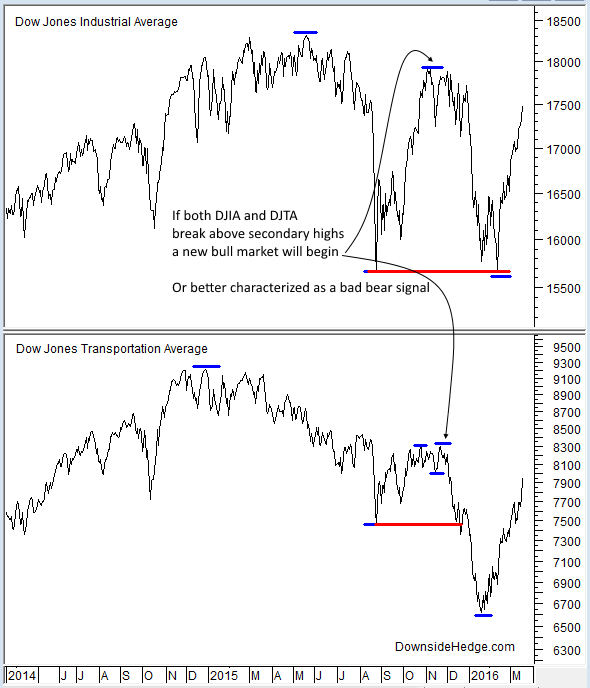

Dow Theory is still indicating that we’re in a bear market. If the last secondary highs are broken, I’ll consider the last signal as a whipsaw. Whipsaws don’t happen often in my Dow Theory counts so it would be out of character if we get a break out to new highs. But, if we do break higher we may see a blow off type move.

Conclusion

The long term trend still appears to be down, but we’re getting close to a point where the market must turn down or the long term bull will live on.

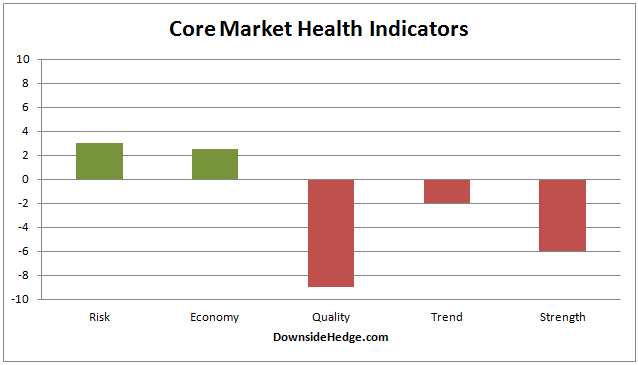

There were no substantial changes to my core market health indicators this week so there are no portfolio allocation changes.

Leave A Comment