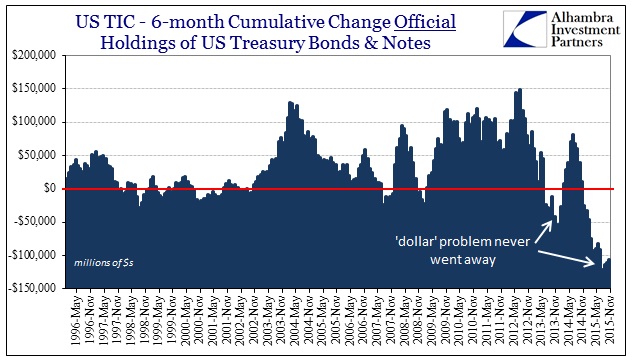

The November update for TIC figures shows relatively few surprises given what was witnessed November into December then January. The heavy downdraft of October was somewhat reversed, and even the official sector was probably less strained (outside of China) than at any time in 2015. But these are reactive symptoms to the greater problem of “dollar” availability, so the most important numbers in terms of forward indicators of TIC are not necessarily UST’s or dollar-denominated assets.

There is certainly some lagged effects here, as the massive “selling UST’s” in October was surely trailing the events of August and September; particularly central banks trying to catch up to the illiquidity as best they can (under orthodox constraints, including anachronistic philosophy). So where there was net selling of $50 billion for October, including -$17 billion in the official sector, November rebounded to net buying of $41 billion with only a net $152 million in official sales.

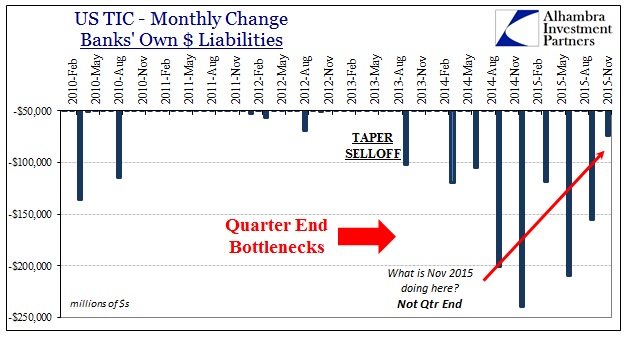

These are, again, only effects of the general eurodollar environment which is generated almost exclusively by eurodollar banks. The TIC figures provide a loose proxy for that very notion, estimating reported changes (flows) in bank liabilities denominated in dollars. Since the 2013 taper drama, these bank liabilities have shown a quarterly tendency to collapse in the last month of each quarter and then rebuild only somewhat during the next. That may account for what looks like a ratchet or waves of “dollar” effects globally.

When looking at it just in terms of quarter-ends, that much is apparent. However, as is highlighted immediately above, November 2015 shows up where only December 2015 should. There was a massive outflow or diminishment in reported dollar liabilities in November; far out of line with everything we have come to expect of this quarterly pattern since QE3. In fact, isolating only the middle month of each quarter makes this very plain.

Leave A Comment