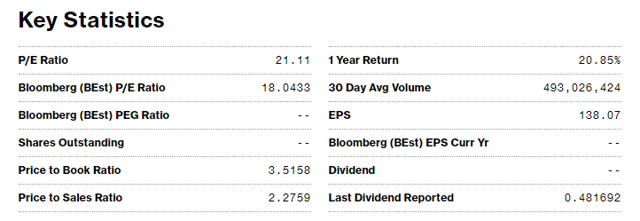

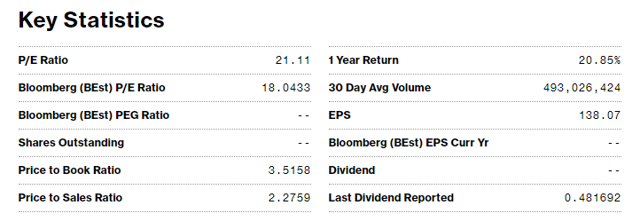

According to the Bloomberg, the S&P 500 (SPY) is trading at 21 times earnings and returned 20.85% in the last 12 months.

Snapshot 1 – S&P 500

(Source: Bloomberg)

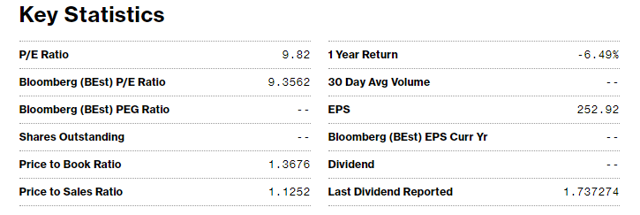

Snapshot 2 – SSE 50

According to the same publication, the SSE 50 is trading at 9 times earnings and returned -6.49% during the last 12 months.

(Source: Bloomberg)

Probably, this makes a pretty good opening case in favor of Chinese stocks. However, first, we need to understand what is happening.

Why Is China Decoupling From Developed Markets?

We might formulate the following reasoning: the trade war is leading to weakness in the most vulnerable economies. Countries with current account and budget deficits, together with shallow depth external reserves, are more likely to suffer from the shock waves of the trade war.

Imagine we were entering the year 2017. Looking at the following tables, which countries do you think would be more likely to have a currency crisis?

Table 1 – Short-term debt (% of total Reserves)

(Source: World Bank)

Table 2 – Total reserves (% of total external debt)

(Source: World Bank)

Remember that reserves are mainly influenced by trade, remittances and loans. For instance, countries can improve their reserves by being net exporters, receiving remittances from emigrants or taking loans. However, taking loans is only a temporary measure and might even produce a debt crisis near maturity, if the roll-over is unlikely.

Since governments don’t usually want their citizens fleeing the country, incentivizing emigration to build a steady flow of foreign currency is not a viable long-term policy. Therefore, we might assume that countries with balanced budgets and net exporters are the ones who should be able to grow their currency reserves steadily.

Theoretically, countries under the current flexible foreign exchange system shouldn’t need reserves. However, evidence has made it clear that countries with high levels of reserves have been less subject to crisis impact.

Leave A Comment