The end of the year is here again, and 2015 looks like it is giving the average investor the opportunity to do what he does best: shoot himself in the foot.

And it’s the retired person who is the hardest hit.

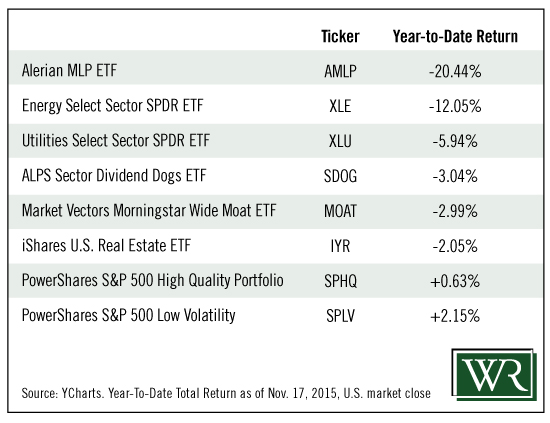

The returns for the exchange-traded funds (ETFs) listed below tell the whole story:

This list is a fairly good representation of the typical holdings a retired or conservative investor holds: utilities, big-name energy, REITs, low volatility… You get the picture.

And, except for two, they are all down for the year.

This is exactly the type of short-term, volatility-driven dip in the market that derails most small investors and drives them to sell at a loss.

They dutifully do their year-end calculations. They see they either made no money or had a loss for the year. They then conclude this stock thing doesn’t work and either sell all their losers or, worse, cash in and throw the babies out with the bathwater.

All because we had a volatile year. Not a bad year, a volatile year! From a long-term perspective, it wasn’t bad at all.

On December 1, 2014, the Dow was at 17,823. At the close on November 27, 2015, it sat at 17,798.

That’s only a 25-point drop for the broad market. Despite some crazy ups and downs, 2015 was nothing.

But none of that will matter.

Many will still get that disgusted or scared feeling because their holdings are down. They will curse the market and throw their statements in the garbage and do what they are famous for: They’ll sell at a loss.

And the saddest part of this whole scenario is the losses will be completely unnecessary because investors will be reacting to volatility, not market risk or even eroding fundamentals.

In the ’80s, the buzzword was growth. In the ’90s, no one could talk about anything but cellular technology, computers and the Internet. Now the buzzword is volatility. You can’t read an article or listen to an interview without it coming up.

Leave A Comment