96% technical buy signals

14 new highs and up 13.34% in the last month

Relative Strength Index 71.12%

ILG, Inc. offers owners, members and guests benefits and services, as well as destinations through its portfolio of resorts and clubs. The company’s operating businesses include Aqua-Aston Hospitality, Hyatt Vacation Ownership, Interval International, Trading Places International, Vacation Resorts International, VRI Europe and Vistana Signature Experiences. ILG, Inc., formerly known as Interval Leisure Group Inc., is headquartered in Miami, Florida.

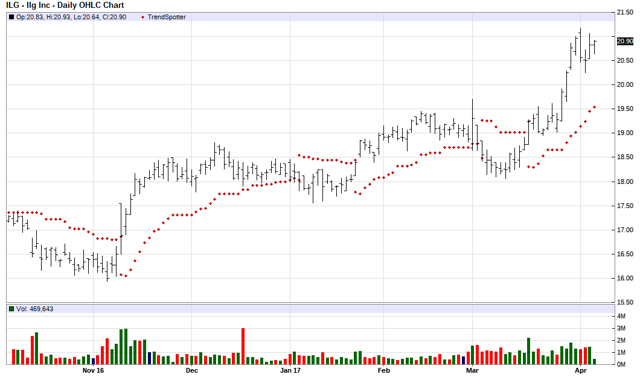

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

14 new highs and up 13.34% in the last month

Relative Strength Index 71.12%

Technical support level at 20.56

Recently traded at 20.87 with a 50 day moving average of 19.19

Fundamental factors:

Market Cap $2.60 billion

P/E 12.50

Dividend yield 2.93%

Revenue projected to grow 29.80% this year and another 4.50% next year

Earnings estimated to increase 11.40% next year and continue to compound at an annual rate of 15.00% for the next 5 years

Wall Street analysts issued 5 strong buy recommendations on the stock

Leave A Comment