– New Zealand 2Q GDP to Expand Annualized 3.6%- Fastest Pace of Growth Since 4Q 2014.

– Will Stronger Growth Push the Reserve Bank of New Zealand (RBNZ) on Keep Rates on Hold?

Trading the News: New Zealand Gross Domestic Product (GDP)

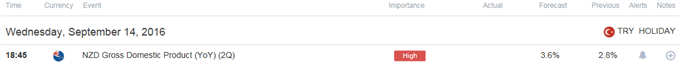

New Zealand’s 2Q Gross Domestic Product (GDP) report may boost the appeal of the kiwi and spark a near-term rebound in NZD/USD as the economy is projected to expand an annualized 3.6% following the 2.8% rate of growth during the first three-months of 2016.

What’s Expected:

Why Is This Event Important:Even though the Reserve Bank of New Zealand (RBNZ) endorses a dovish outlook for monetary policy and warns ‘current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range,’ data prints pointing to a stronger recovery may encourage Governor Graeme Wheeler to preserve the current policy at the next interest rate decision on September 22 as it instills an improved outlook for growth and inflation.

Expectations: Bullish Argument/Scenario

Release

Expected

Actual

Manufacturing Activity s.a. (QoQ) (2Q)

—

2.2%

Employment Change (QoQ) (2Q)

0.6%

2.4%

Retail Sales ex. Inflation (QoQ) (2Q)

1.0%

2.3%

The rebound in business outputs accompanied by the pickup in household consumption may generate a larger-than-expected expansion in the growth rate, and a positive development may spark a bullish reaction in the New Zealand dollar as market participants scale back bets for another RBNZ rate-cut.

Risk: Bearish Argument/Scenario

Release

Expected

Actual

Terms of Trade Index (QoQ) (2Q)

-1.5%

-2.1%

Trade Balance (JUN)

150M

127M

Credit Card Spending (MoM) (JUN)

—

-0.8%

Leave A Comment