Back in November 2013, when few had an idea just how massive China’s debt bubble truly was, we explained “How In Five Short Years, China Humiliated The World’s Central Banks” and said the following:

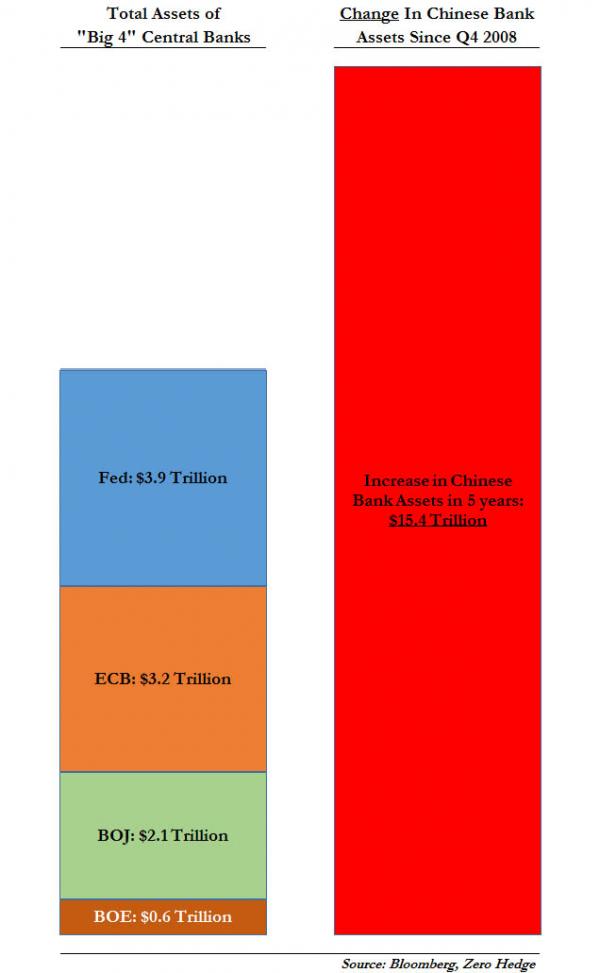

In order to offset the lack of loan creation by commercial banks, the “Big 4” central banks – Fed, ECB, BOJ and BOE – have had no choice but the open the liquidity spigots to the max. This has resulted in a total developed world “Big 4” central bank balance of just under $10 trillion, of which the bulk of asset additions has taken place since the Lehman collapse.

How does this compare to what China has done? As can be seen on the chart below, in just the past 5 years alone, Chinese bank assets (and by implication liabilities) have grown by an astounding $15 trillion, bringing the total to over $24 trillion, as we showed yesterday. In other words, China has expanded its financial balance sheet by 50% more than the assets of all global central banks combined!

And that is how – in a global centrally-planned regime which is where everyone now is, DM or EM – your flood your economy with liquidity. Perhaps the Fed, ECB or BOJ should hire some PBOC consultants to show them how it’s really done.

To give a sense of perspective of the numbers involved, we showed the following chart:

To be sure, since November 2013, all those numbers have grown substantially, especially at the ECB and BOJ but nowhere more so than in China, where a little over a year later, a famous study by McKinsey showed that not only has the world not delevered, but that the global “debt creation dynamo” was none other than China…

… whose debt/GDP has since grown to an even more astronomical 350% (and rising exponentially).

China’s – and the entire world’s – debt load was very much the highlight of the latest BIS quarterly report (profiled yesterday) in which we learned that the “BIS calls time on world credit binge” and that “China’s Leaders Put the Economy on Bubble Watch” even as these same leaders just raised their budget deficit forecast to its highest ever and previewed an even faster increase in its monetary aggregates or M2, which is now supposed to pick up to 13% per year, or roughly double China’s GDP growth rate.

Leave A Comment