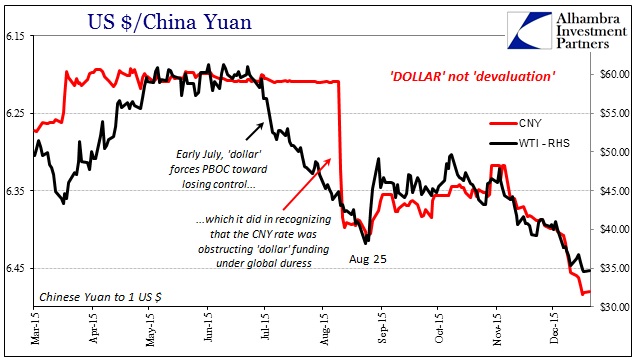

There are a few correlations that I find particularly compelling. The first is Chinese RMB (or CNY) next to WTI crude oil, as both are proxies in their own way of multi-dimensional crosscurrents between global “dollar” finance and real economy function. Since March, that correlation has come into renewed and tight focus. In the past few days, the CNY has traded and fixed narrower, perhaps indicating an end to the latest run that has demonstrated huge “dollar” tightness. WTI, however, is still on the way down “catching up” to CNY and thus signaling instead only a short-term pause in the financial downgrade and downdraft.

The second is the Russian ruble compared to more “mid-grade” US corporate junk. Again, you have the same overtones of finance and real economy, with both indications presenting heavy energy exposure but nowhere limited to just that. The ruble declares Russia’s expected oil fortunes, and thus the ability to “service” dollar financial conditions, but also more than that as the overall Russian economy sinks toward its next abyss. The BofAML High Yield Master II index is very much the same, undoubtedly with a high proportion of energy-related junk obligors but increasingly the selloff attains much more shifting risk perceptions about those raw economic circumstances (the credit cycle in general, as the worst of junk increasingly has already greatly strained the boundaries of expectations for default).

Here, unlike January and February, the ruble has held up comparativelywell after August 24 and 25. Given the state of the Russian economy, I’m not too sure that isn’t an ill omen in terms of the junk bubble. In other words, in the first “dollar” wave the ruble declined faster and sharper, while this time it is US junk that throws off so much complacency. To me, that says a lot about how “transitory” was viewed in both participants only to converge at this later stage.

Leave A Comment