The mining sector has endured tremendous weakness of late with slumping commodity prices for precious metals, coal, iron ore and copper weighing heavily on profitability. That the sharp declines were led by Chinese weakness are not to be underestimated. Binary options traders had a field day shorting the aforementioned commodities, but it appears that the tide may be turning for a group of FTSE 100 mining companies. Recall that Glencore PLC (GLNCY) led the way as the worst performing company on the FTSE 100 index? That trend has been reversed and we’re seeing some solid steps being taken to help shore up this massive mining company’s share price, earnings and long-term profitability.

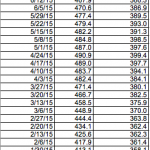

1-Year Performance of the FTSE 100 Index

The reason I’m focusing on Glencore PLC is pretty simple – this company led strong declines in the FTSE 100 index from July through October. The reversal we’re seeing is largely a result of renewed confidence in mining stocks which I maintain are still highly undervalued.

Quick Facts to Help You Make Trading Decisions:

Glencore Price Reversal 4 November 2015

– Glencore PLC is cutting debt by $10 billion to $20 billion within a year

– Glencore PLC is on track to save $2.4 billion by not paying Q4 dividends

– Glencore PLC is cutting copper production by 455K tonnes within 2 years

Anglo American Reversal November 4, 2015

Why the Sudden Reversal in Mining Stocks on the FTSE 100?

China has as much to do with the upswing as it did with the downswing. Recent upbeat comments – backed up by concrete plans – by the president in China have helped markets to rally. The spike in the FTSE 100 has been matched by positive gains in major European bourses too. Oil stocks and mining stocks have reacted positively to news from China. This is particularly good news for the FTSE 100 index which is heavily weighted by the mining and energy sectors. While the gains so far on the FTSE 100 are marginal – they are positive and that’s precisely what binary options traders need when deciding whether to place call or put options on the index. The FTSE 100 was trading at 6,428.43 at 3PM GMT – up 0.70% for the day, or 44.82 points. And the reason why everyone is bullish vis-à-vis China is the uptick in Services PMI. That is definitely an important economic tidbit for the global economy.

Leave A Comment