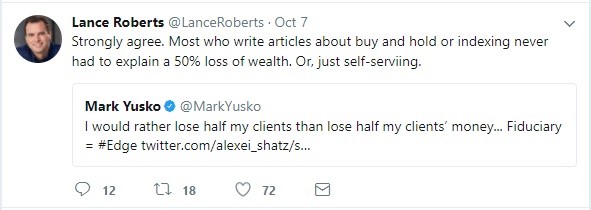

I caught an interesting exchange on Twitter between old friend Mark Yusko and Lance Roberts as follows;

This conversation gets to the heart of one of the major themes of this blog going back to the beginning. Indexing, where the context is buying passive funds and holding on no matter what, is, of course, valid and can get the job done but the drawbacks are considerable and partially captured in the tweets.

To my way of thinking, there is no question that the bull/bear cycle is alive and well, there will be a bear phase that comes along at some point and then after that, the market will make a new high at some point. In that context, holding on no matter what all the way through, subject to a proper asset allocation can absolutely work.

There are at least a couple of things that get in the way of this idea both having to do with reality. The first reality is behavioral (more on behavior below). Everyone has a plan till they get punched in the mouth—so said, Mike Tyson. The very rational idea that markets always recover sounds great until someone sees there account down 40% and has convinced themselves that this time is different.

It is that moment where people lose sense of ration, cannot be talked out of doing the wrong thing, panic sell and then watch the market go back up without them. The phrase that came into vogue to describe this scenario back during the crisis was permanent impairment of capital.

The other bit of reality that can have nothing to do with behavior but can still permanently impair capital is circumstantial. Every so often most of us will have something come up that forces us to spend a lot of money unexpectedly. This can be a genuine emergency or a perceived emergency but either way the timing can lousy. Think about what was a $1 million account at the top which then becomes a $500,000 account at the bottom. You see where this is going, a $50,000 emergency depending on the timing could be a 5% drawdown or a 10% drawdown such that now the investor is working with $450,000 when they once had $1 million.

Leave A Comment