The stock market in India was our favorite global stock market in 2016 and 2017. We wrote about this extensively as loyal readers know in the meantime: India Stock Market Breaking Out. Is This A Buy Signal? (April 2016), India Stock Market At 9,000 Points, Long Term Very Bullish (February 2017), India Stock Market Remains Bullish (September 2017).

Towards the end of January, the Nitfy 50 index, representing the 50 largest companies/stocks in India, took a dive of 1000 points which represents some 13 percent. As of that point Indian stocks have been weak.

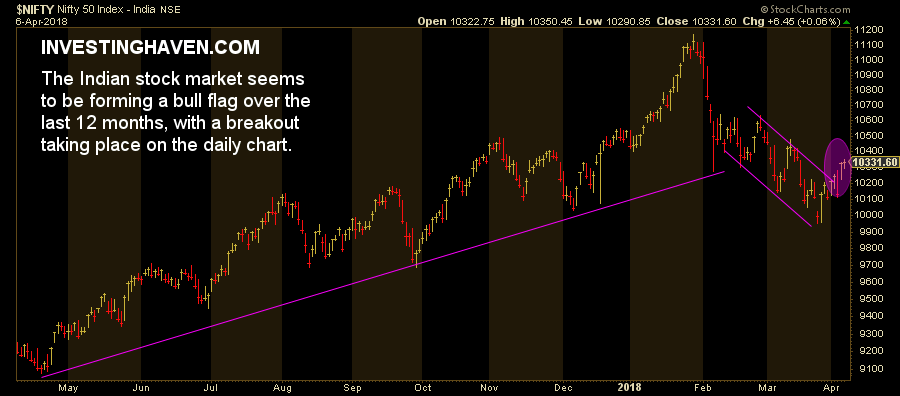

However, there is a bullish sign which is visible. Where and how? Very simple, in analyzing markets, stocks or commodities, we look for early signs on the daily chart, and then zoom out to see what they could mean on the weekly or monthly chart.

If we apply this to the Nitfy 50 we see a breakout of a bullish flag, see the first chart.

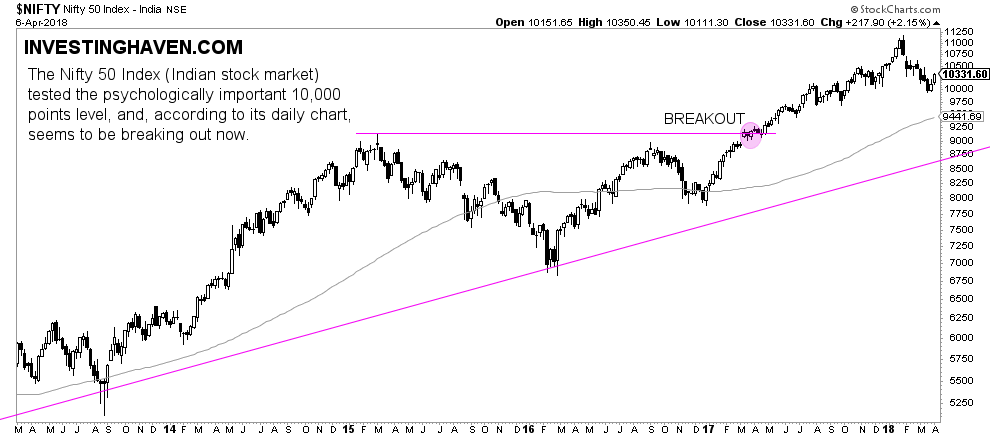

On the weekly chart we get a confirmation that this is meaningful. As said many times before the 10,000 level was a psychologically important area which provided quite some resistance. Recently, this level acted as support.

So the daily and weekly charts are nicely aligned, and the breakout on the daily nicely lines up with the findings on the weekly. We get very bullish again on India, and see a buy opportunity for the longer term. The most popular ETFs are INDA and INDY, with INDL being an ETF with 3x leverage (be extremely careful with leverage though we certainly do not recommend leverage).

Leave A Comment