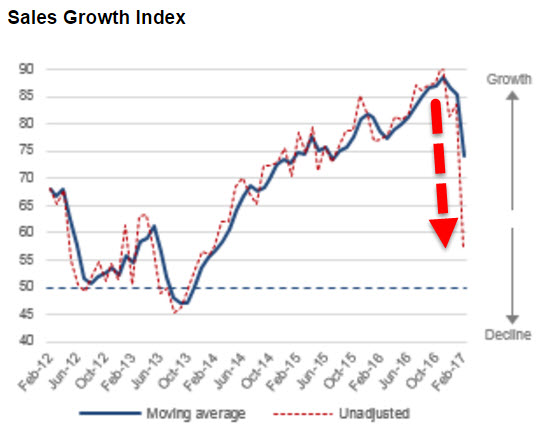

The Sales Managers Index (SMI) is one of the earliest monthly indicators of Indian economic activity. February’s data shows the catastrophic after-effects of the December demonetization policy which was intended to crack down on corruption and ‘black money’.

The February Headline SMI has fallen to an index level of 60.2 in unadjusted terms, the lowest level in over 3 years.

Sales Managers Index (SMI)

Managers are reporting a big drop in monthly sales for both the consumer and industrial sectors, with small to medium size businesses that predominantly deal with cash transactions, being hardest hit.

Sales Managers Index (SMI)

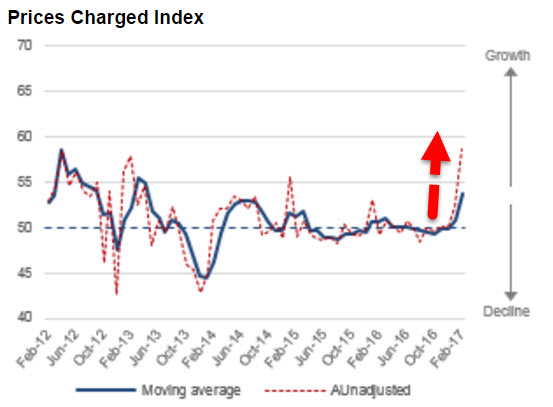

Furthermore, the cash policy has had the effect of forcing up the overall Prices Charged Index (53.6) to levels not seen since spring 2013, when the Rupee was valued at ?53.92 against the USD, it is now trading at? 67.29. Some panel members are expecting the currency to continue to fall.

Sales Managers Index (SMI)

Higher inflation in the consumer goods and services sectors, represented by the Prices Charged Index for Services (54.7), is pushing the valuation of the Rupee to even greater levels of undervaluation on the World Price Index (WPI) scale. The WPI under valuation level for the Indian Rupee is currently -41% using February data. Businesses are taking advantage of the situation created by such an undervalued currency, with the majority of panel members feeling that the current FX level is becoming advantageous for their businesses.

Overall, February SMI data suggests an erratic situation for Indian businesses as they meet market challenges with considerably lower levels of confidence, slower monthly sales and higher prices caused by the currency situation.

Leave A Comment