Share markets in India are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the energy sector and IT sector witnessing maximum selling pressure. Realty stocks and healthcare stocks are trading in the green.

The BSE Sensex is trading down 11 points (down 0.1%) and the NSE Nifty is trading down by 20 points (down 0.2%). The BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.6%. The rupee is trading at 64.28 to the US$.

In the news from telecom sector… As per an article in the Economic Times, bankers have told the government that telecom companies are on the verge of defaulting their loans.

This, they say, is because competitive pressures, especially after the launch of Reliance Jio in September last year, have created a severe financial stress on the business dynamics of the industry.

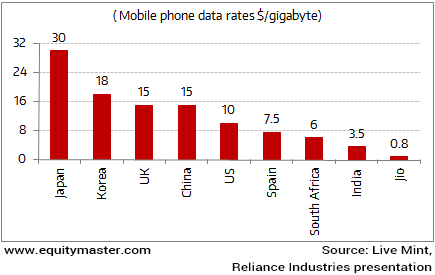

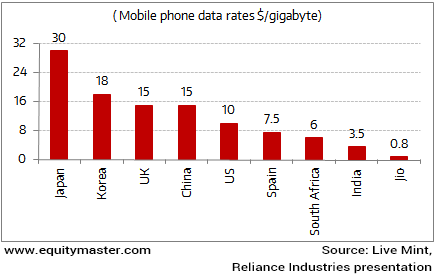

One shall note that Indian telecom players are facing the brunt on the back of Reliance Jio’s aggressive pricing strategy, as can be seen in the chart below. To catch up with the competition, many players have started offering similar services. But the aggressive pricing has dented the overall health of these telecom companies.

Jio’s Data Pricing to Disrupt the Telecom Apple Cart

Further, higher investments to upgrade infrastructure had stretched their balance sheets. Also, the regulatory costs for the telecom industry have shot the through the roof. After 122 licenses were cancelled by the Supreme Court, the new spectrum airwaves were auctioned off at exorbitantly high prices pushing telecom companies neck-deep in debt.

You can check the financial health of telecom companies by running a query in the Stock Screener section. This gives you the option to run a sector-wise query for top 10 stocks.

Also, Apurva Seth, at Profit Hunter, took a look at the telecom sector recently. And it doesn’t look good. Here’s Apurva’s conclusion after studying the charts…

Leave A Comment