Indian share markets are trading marginally higher after taking cues from the budget announcements. Sector indices are trading on a mixed note with stocks in the information technology sector and healthcare sector witnessing maximum selling pressure. Stocks in the realty sector are trading in the green.

The BSE Sensex is trading up 69 points (up 0.3%) and the NSE Nifty is trading up 17 points (up 0.2%). The BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 67.61 to the US$.

Financial markets are keeping tabs on various announcements from Finance Minister Arun Jaitley’s budget speech. So far Mr. Jaitley has touched upon some macroeconomic topics. He had announced that inflation has been controlled and the government has successfully launched massive war on black money.

As per Mr. Jaitley, the government will continue to uplift vulnerable sections of the society. Its focus is to energise youth and create jobs.

Apart from the above, Arun Jaitley also touched upon the demonetisation move and said that its impact is not expected to spill over to next year as the pace of remonetisation has picked up in the economy.

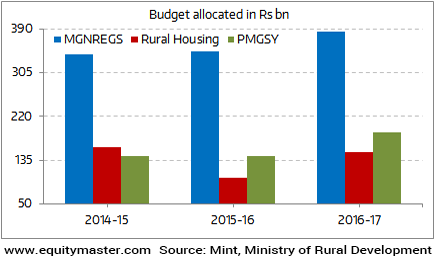

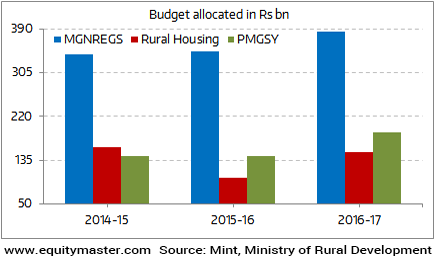

The overall approach in budget, as per Mr. Jaitley, has been to spend more in rural areas.

Budgets have had a historical trend of rising allocation for rural welfare. This is seen in the chart below:

Will the Government Continue to Oblige?

Notes:

MGNREGS – Mahatma Gandhi National Rural Employment Gurantee Scheme

PMGSY – Pradhan Mantri Gram Sadak Yojana

The government should fetch enough revenue so the above expenditure does not come through additional debt.

Owing to the above announcements, Indian Indices are trading on a volatile note. Also, market participants are watching out for themes in the budget that could affect their stocks.

My friend Kunal Thanvi wrote to you yesterday about some of these themes in The 5 Minute WrapUp. These included the fiscal deficit and financial stocks, the defence theme, digital India, etc. Apart from that, he also pointed two broad themes that investors should watch out for in the budget. Here’s an excerpt:

Leave A Comment