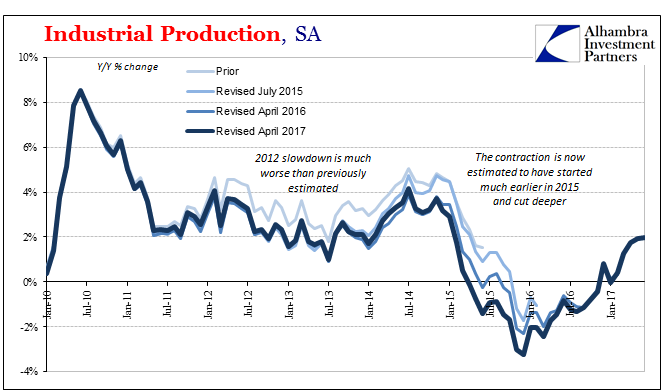

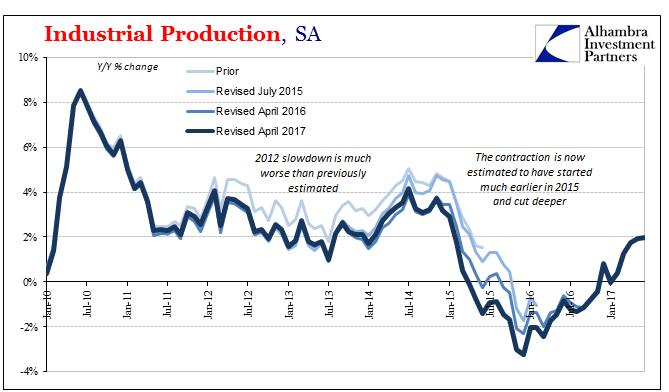

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even possible end to the mini-improvement cycle.

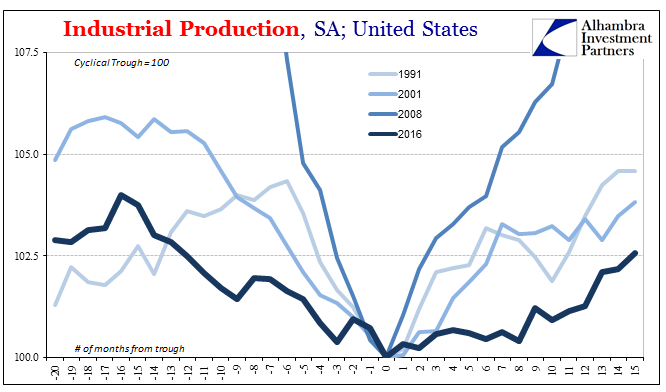

The trajectory for US industry on the plus side now continues to undershoot both the 2002-03 as well as the 1992-93 “jobless recoveries.” In that respect, Industrial Production has yet to reach 2014 comparisons; average growth in 2014 was a small 3.5% at the highest average that year, whereas in 2017 the 6-month average is but 1.2%.

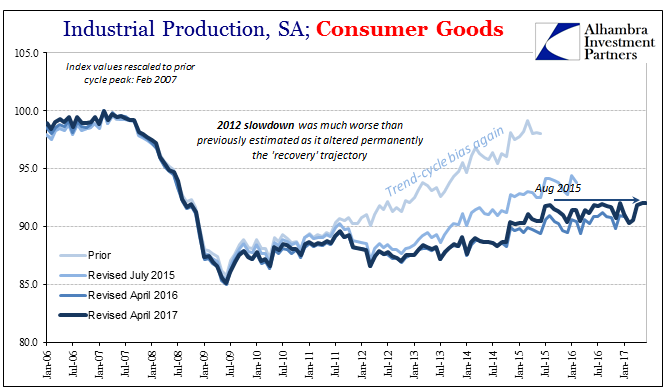

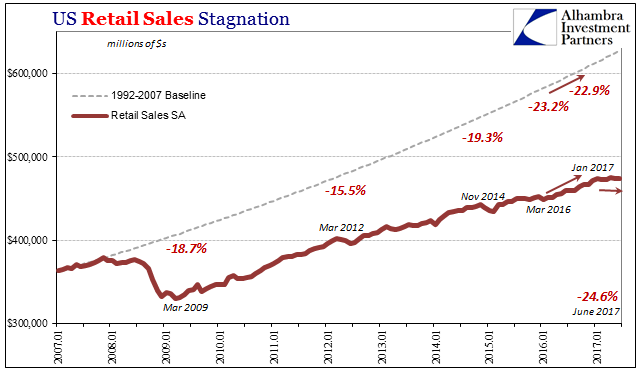

Production of consumer goods has been largely flat and sideways going back to the eventful summer of 2015. Despite an overall economic shift toward positive growth again, US manufacturers haven’t been given any boost in the consumer segment – even though production levels here are still 8% below the peak in 2007 a decade ago.

The primary reason for downside weakness continues to be domestic auto production. For the sixth consecutive month, motor vehicle assemblies were estimated to have been less than 12 million (SAAR). That is about equal in production runs to 2014, meaning well behind the growth pace of that year.

Auto production is right now merely keeping up with lower sales. Unless consumers start buying up what has been piled up in inventory, at some point in the near future carmakers are going to have to make deeper cuts. At the moment, they are going at record incentive rates just to keep sales from falling further, cutting into profits as a short-term solution.

Leave A Comment