Industrial Production Growth Is Solid

Since industrial production is a hard data report, it will settle the score on whether manufacturing growth was strong. I was unsure of the situation in August because many soft data reports conflicted with each other.

The final tally is manufacturing was solid, but not as amazing as the ISM PMI indicated. That’s not a surprise because the ISM PMI has often been too positive in this expansion.

Industrial production was up 0.4% month over month which met estimates and last month’s report. July’s report was revised up from 0.1% growth. Month over month manufacturing growth was 0.2%.

This missed estimates and July’s growth which were 0.3% growth. The capacity to utilization rate was 78.1% which missed estimates for 78.3%. It was up from July’s rate which was revised from 78.1% to 77.9%.

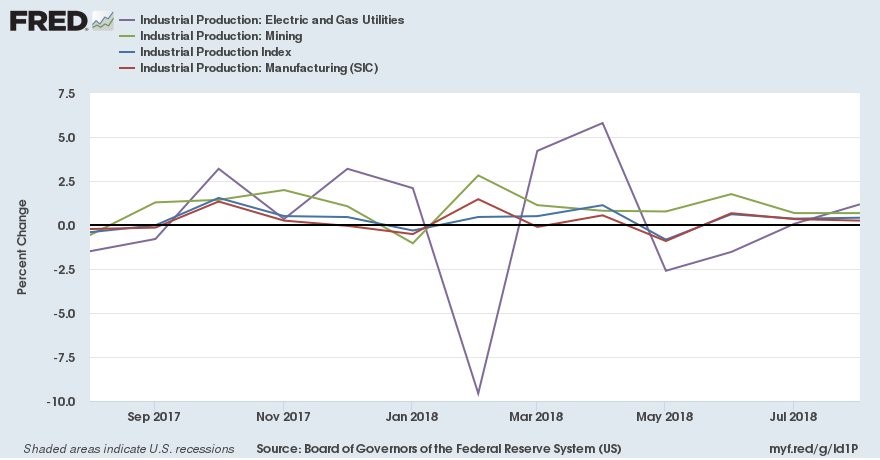

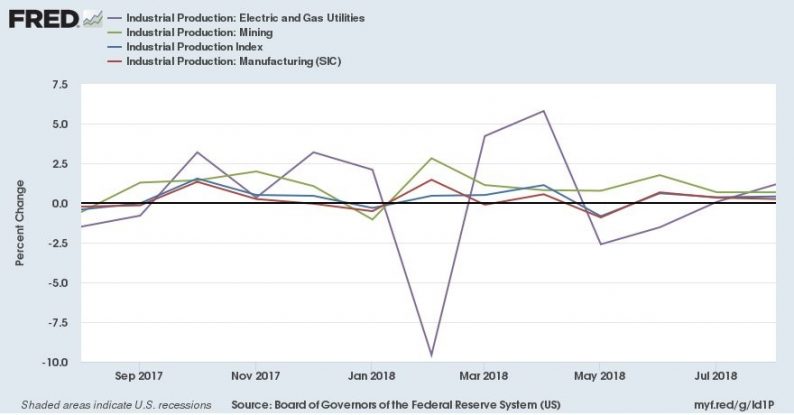

The chart below shows the components of the industrial production report. As you can see, the electric and gas utilities component was up 1.18% which is up from July increase of 7 basis points.

The mining industry was up 0.67% in August which is an improvement from 0.67% in July (there was an improvement in the thousandths place). The overall index technically improved if you look at the hundredths place as it went from 0.36% to 0.41%.

Finally, the manufacturing segment went from 0.33% growth to 0.249%. As you can see, it was just one, one-hundredth of a point away from being rounded up which would have met estimates.

Industrial Production Growth – Auto production was actually up 4% even though it has seen weakness recently.

Retail sales for autos fell 0.8% in August. Autos couldn’t boost the whole manufacturing segment as non-industrial supplies including construction supplies had no growth.

Output of hi-tech goods and business equipment were both up solidly. If we think back to the Beige Book, the Fed was correct to say the manufacturing sector was seeing moderate growth.

Leave A Comment