Written by UpFina

One of the major trends of 2018 is likely to be the acceleration of inflation growth.

The Fed has longed for inflation for years because it consistently has been below its goal of 2%. It’s a strange goal to have because it means the purchasing power of the consumer decreases. The theory, from the perspective of the Federal Reserve, is that if inflation is increasing it means demand for scarce good is improving thus indicating that the economy is strong. The key determining factor for the economy is how the fiscal stimulus, which is the Trump tax cut and spending increases affects the labor market. Is there any slack left in the labor market after an 8.5 year expansion? If the economy is at full employment this tax cut could cause a sharp increase in wage growth which would hurt corporate profit margins and boost inflation. The low unemployment rate supports this notion. If there is still slack in the labor market, as supported by the labor participation rate and the underemployment rate, then wage growth would increase modestly as the economy accelerates.

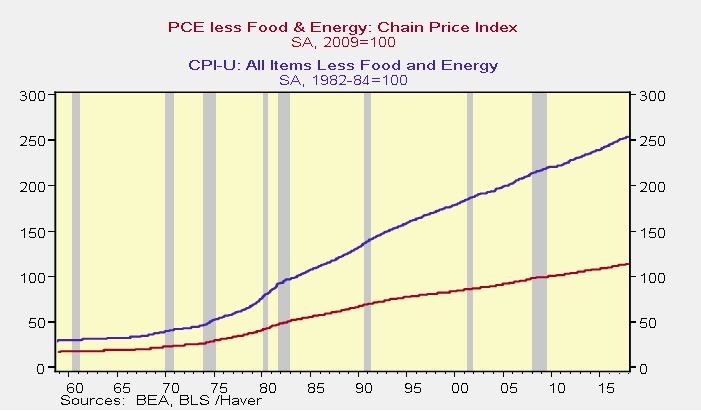

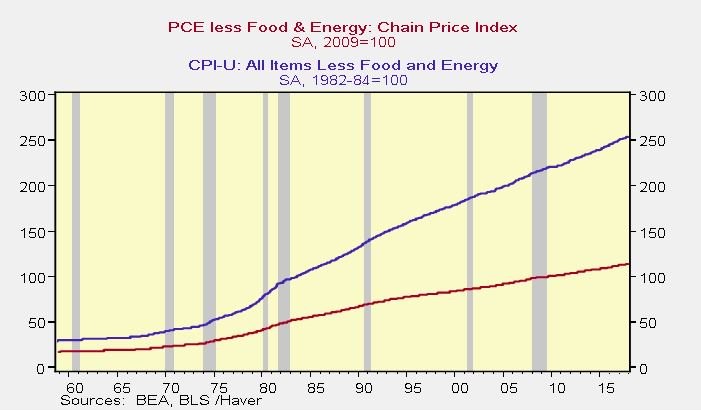

Inflation is a tricky thing to track because there are so many metrics that calculate it. The two most common measures are the CPI and PCE. The Fed likes to look at the core inflation for both of those measures. Core inflation is when the measurement ignores changes in food and energy prices. The Fed leans towards looking at the core PCE. That’s an important distinction because the core PCE has been much lower than the core CPI. If the Fed thinks inflation is low, then it will be more accomodative in monetary policy which means lower rates and a bigger balance sheet. The chart below shows the historical changes in the core CPI and core PCE. As you can see, the gap between the two has increased steadily.

Core CPI Is Usually Higher Than Core PCE

Inflation Increases In January

The latest CPI report showed month over month inflation was up 0.5%. The annualized inflation was 2.1%. Core inflation was up 0.3% month over month and the annualized result was 1.8%. On this measurement, the Fed’s target wasn’t hit. Even though the goal wasn’t reached, it got market participants talking about the economy entering a new period of inflation. The data points which have the most impact on the market are the ones which confirm a pre-existing concern. You would think a completely unexpected report would cause the market to react, but often the reports which are completely out of line are dismissed because of weather effects or simply volatility in the report. We’re not saying expectations aren’t important. They are critical. The month over month CPI and core CPI beat expectations by 0.2% and 0.1% respectively. This report came into focus because the trend the market had expected would develop, got stronger.

Leave A Comment