The Australian inflation number remained below expectation in the final quarter of 2017, highlighting the challenges faced by the Reserve Bank of Australia in meeting inflation target.

Consumer Price Index (CPI) which measures inflation increased by 0.6 percent in the fourth quarter of 2017, slightly below the 0.7 percent expected by economists and same as the 0.6 percent recorded in the third quarter. Indicating that improved global outlook fueling growth in emerging economies is yet to translate to rise in consumer prices.

Inflation rate rose 1.9 percent year-on-year, also below the 2 to 3 percent targeted by the central bank. The weak inflation rate has been attributed to weak wage growth even with the historic unemployment rate.

“Global competition, increased automation, decreased unionization, reduced collective bargaining and the increased casualization of the workforce have largely contained pay increases,” said Ryan Felsman, a senior economist at CommSec.

“There is increasing uncertainty about the size and timing of how wage pressures might eventually pass through to prices.”

In an effort to boost consumer prices, the central bank left interest rate at a record-low of 1.5 percent since the second half of 2016 and experts believed the apex bank may not be raising rate anytime soon as growing job creation has failed to stimulate inflation rate for the second year in a roll.

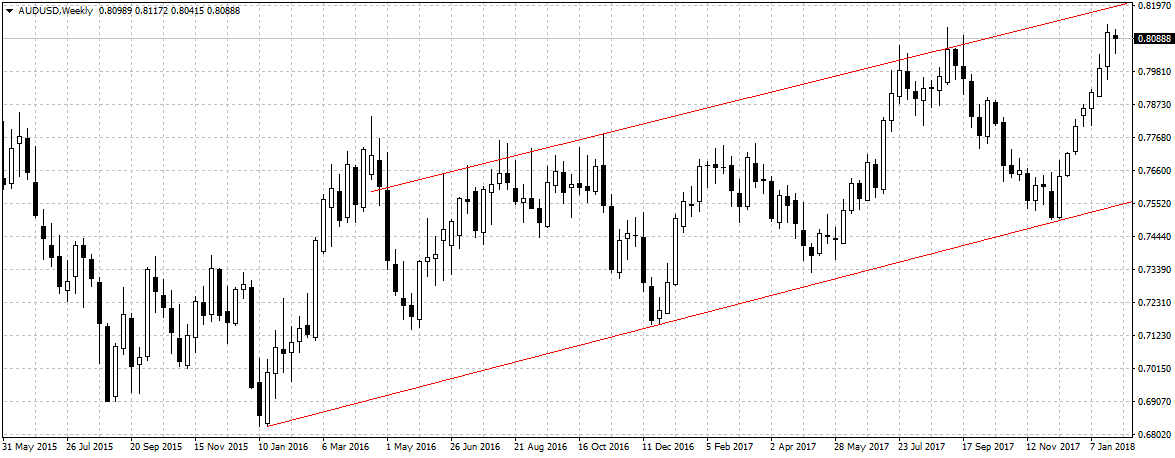

The Australian dollar fell a quarter of a U.S. cent to 0.8045 before rebounding above 0.8087.

Leave A Comment