How Much Will Inflation Pick Up

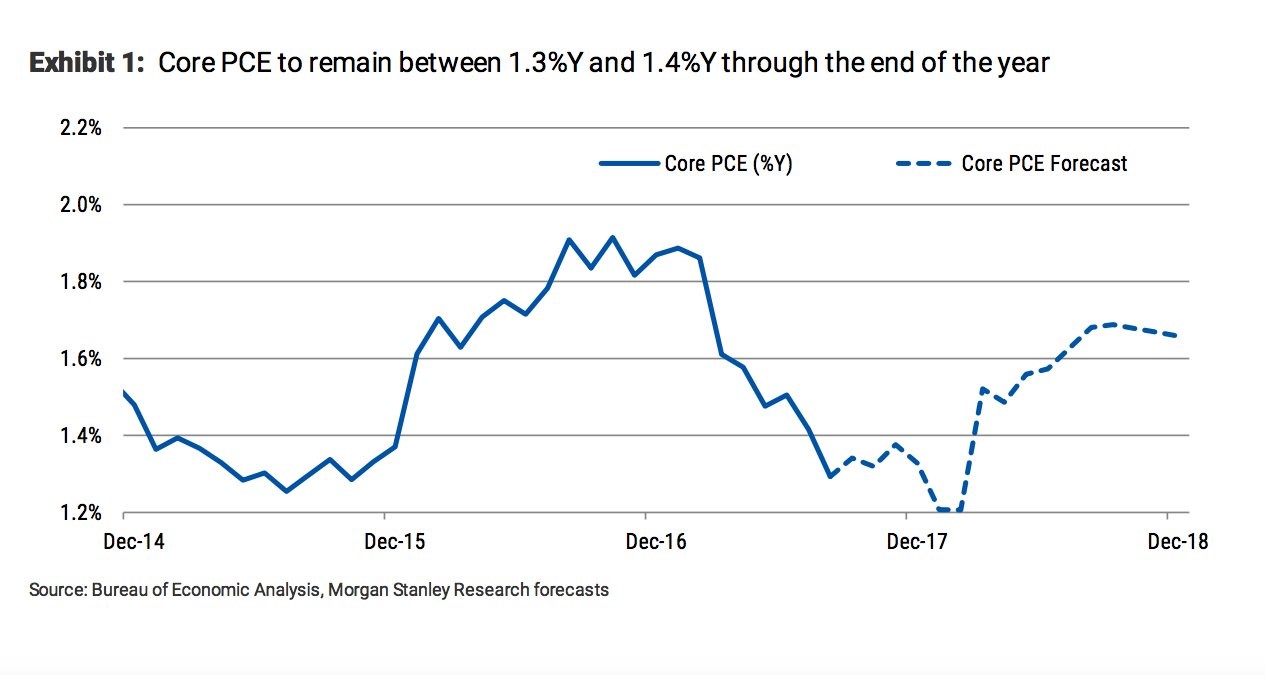

We’ve discussed inflation in previous articles. I think it will increase because the M2 money velocity is up, the NY Fed underlying inflation index is up, and the ISM manufacturing index is up. There has also been a further decline in the unemployment rate which should lead to inflation eventually. Although it doesn’t affect core inflation, oil has also been rallying as it’s now at the $57 handle. It’s somewhat surprising to see oil fall with the dollar index and rally with it. That shows how the currency impact is only one aspect of the price. The chart below shows Morgan Stanley’s prediction for core PCE. The core PCE is less volatile than the CPI, so moves less than 1% are considered big. As you can see, Morgan Stanley is predicting inflation to increase to about 1.7% next year. That will likely push headline CPI to above 2%. If the growth in inflation only goes up that much, there won’t be anything to worry about. My fear is core PCE getting above the 2015 peak.

Part of the fear of inflation is that the Fed will get too hawkish causing the yield curve to invert and thwart lending growth. JP Morgan expects 4 rate hikes in 2018. I think that would push the economy close to a recession. It’s not being priced into the market now, so that change would have big effects on the markets. I have been saying 2 rate hikes is the most likely 2018 policy. If you just look at the core PCE chart, you’d expect the Fed to raise rates more in 2018 than in 2017 because inflation will be higher. However, the Fed is also doing the unwind. Even though no one seems to be concerned about it anymore, I still think there is some uncertainty surrounding the market’s reaction to the unwind. The problem with expectations is that some bears talked about a crash when the unwind started. Now that nothing is happening, they look foolish. If you had the more nuanced stance that the entire situation is unknown, then you can continue that position without having egg on your face.

Leave A Comment