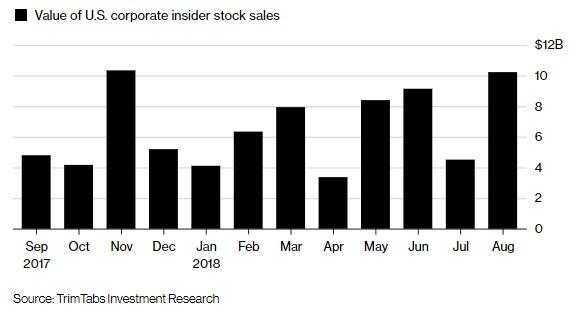

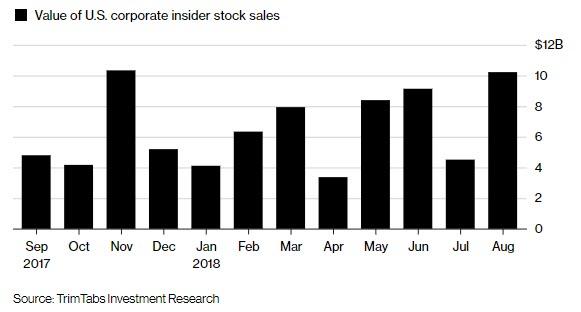

One month ago, we reported that insider selling reached $450 million daily in August, the highest level this year; on a monthly basis, insiders sold more than $10 billion of their stock, the most of any month this year and near the most on record.

“As corporate buying is at least taking a breather, corporate insiders are ramping up share selling as the major U.S. stock market averages are at or near record highs,” TrimTabs wrote in a note.

One month later, TrimTabs is out with a follow up monthly report which finds even more of the same: according to the investment research company, the “best-informed market participants” are selling their own stocks at the fastest pace in September in the past decade, even as stock buyback announcements have hit record levels.

Corporate insiders have sold an average of $400 million daily in September through Friday, September 21, TrimTabs founds, adding that this month’s volume of $5.7 billion is already the highest in any September in the past decade.

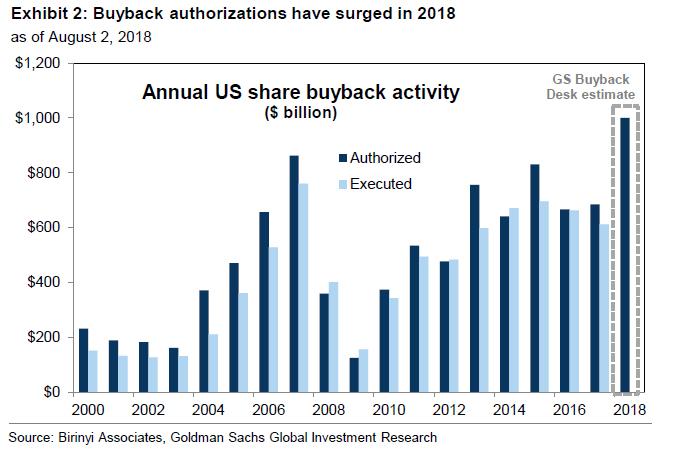

Of course, this comes at a time of record corporate stock buybacks, resulting in a perverse loops in which insiders dumping near-record amount of stock to their own, far less informed, shareholders.

“While insiders are selling hard with their own money, they’ve committed record amounts of shareholders’ money to prop up stock prices this year,” said David Santschi, Director of Liquidity Research at TrimTabs Investment Research.

Indeed, stock buyback announcements by U.S. public companies have already reached $827.4 billion in 2018, topping the previous record of $809.6 billion in 2007 with more than three months left in the year. According to Goldman, the final authorized buyback number will be no less than $1 trillion.

Meanwhile, as buybacks have boomed, U.S. Treasury tax data – contrary to reports from the Bureau of Labor Statistics – indicates that wage and salary growth has been depressed. Real growth in income tax withholdings hovered around 1% year-over-year in the past five months, far below the levels that prevailed last year.

Leave A Comment