Welcome to edition 323 of Insider Weekends. Insider buying increased last week with insiders buying $183.37 million of stock compared to $177.89 million in the week prior. Selling decreased with insiders selling $1.66 billion of stock last week compared to $3.01 billion in the week prior.

Sell/Buy Ratio: The insider Sell/Buy ratio is calculated by dividing the total insider sales in a given week by total insider purchases that week. The adjusted ratio for last week decreased to 9.07. In other words, insiders sold more than 9 times as much stock as they purchased. The Sell/Buy ratio this week compares favorably with the prior week, when the ratio stood at 16.94. We are calculating an adjusted ratio by removing transactions by funds and companies and trying as best as possible only to retain information about insiders and 10% owners who are not funds or companies.

Note: As mentioned in the first post in this series, certain industries have their preferred metrics such as same store sales for retailers, funds from operations (FFO) for REITs and revenue per available room (RevPAR) for hotels that provide a better basis for comparison than simple valuation metrics. However metrics like Price/Earnings, Price/Sales and Enterprise Value/EBITDA included below should provide a good starting point for analyzing the majority of stocks.

Notable Insider Buys:

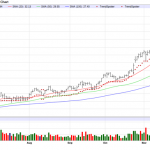

1. Herbalife Ltd. (HLF): $60.5

10% Owner Carl C. Icahn acquired 2,304,683 shares of this nutrition company, paying $59.31 per share for a total amount of $136.69 million. These shares were purchased indirectly through a fund.

We don’t often comment on purchases by 10% owners but this one was much too interesting to ignore and was another volley in the long-standing battle between Bill Ackman on the short side and Carl Icahn on the long side. Herbalife’s stock opened weak on Friday and at one point during the day was down almost 7.8% on news that Carl Icahn was considering selling his large stake in the company and that Bill Ackman had been approached to buy a large block of stock. As the day progressed, the stock recovered some of those losses. After the market closed, Mr. Icahn filed a form 4 indicating he had actually purchased an additional 2.3 million shares and released this statement.

It has been over two years since we wrote the following about the company after a trio of insider purchases at Herbalife.

“Herbalife is currently caught in the cross-fire between longs and passionate short-sellers like Bill Ackman who claim the stock is headed to zero and believe the company is a criminal enterprise. Following Ackman’s latest three hour presentation on the company, the stock shot up more than 25% only to give back all of those gains and then some after the company reported weak second quarter results last week.”

Leave A Comment