This was a very light week of news.Only the BOE had a policy meeting.And other major countries released very few economic numbers.

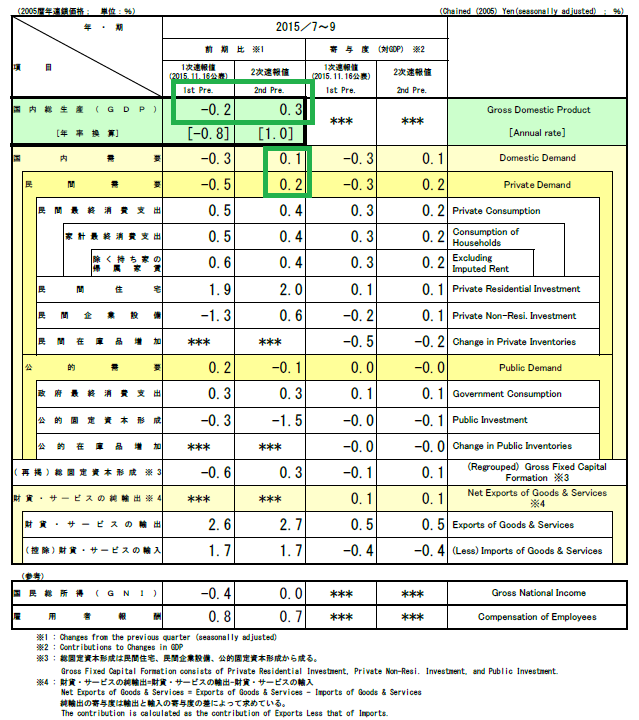

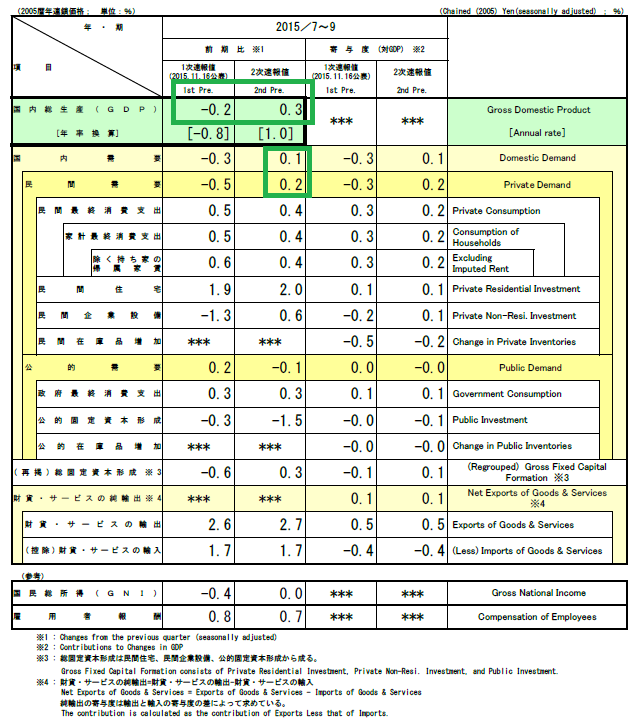

Japanese news was surprisingly strong, starting with an upward revision of 3Q GDP to an annual rate of 1%. This revision means Japan didn’t experience a technical recession. As this table from the report shows, personal consumption expenditures were largely responsible for the positive results:

Unlike other developed countries, Japanese GDP figures are notoriously volatile. Thanks to strong results from job offers and inventory improvements, the LEIs increased 1.3%. Durable goods shipments and industrial production increases were largely responsible for the CEIs rising 2 points. However both composite indicators are still more or less moving sideways for the last year:

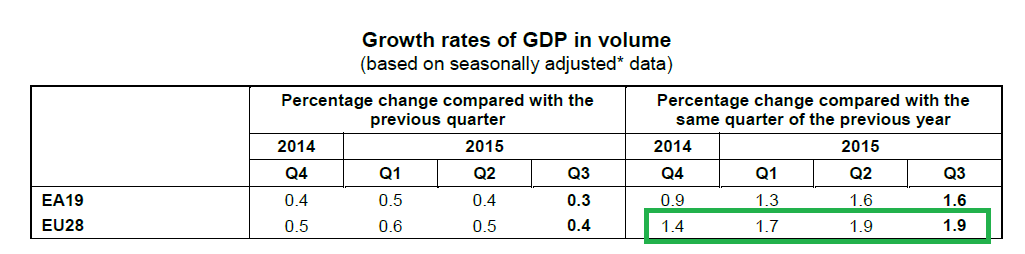

The only news from the euro area was GDP, which increased .4% Q/Q and 1.9% Y/Y.While weak, Y/Y GDP growth is increasing:

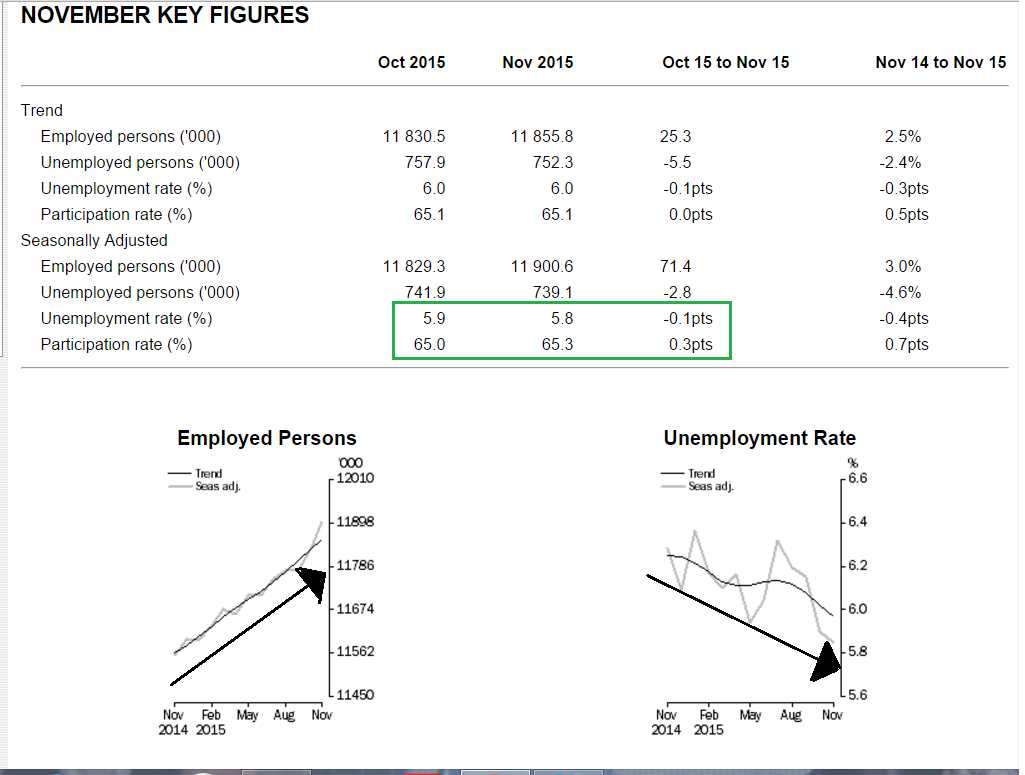

News from Australia was positive. First off, employment increased, the unemployment rate dropped .1% to 5.8% and the participation rate rose .3%. All three are shown in these graphs and tables from the report:

Next, the Australian Industry Group (AIG) released their monthly manufacturing, services and construction reports.The headline manufacturing number increased 2.3 to 52.5, marking the fifth consecutive months of expansion. 7/8 sub-indexes expanded and 5/8 sectors are growing. However, services contracted for a second month with a 48.2 reading. All the sub-indexes contracted while only 4/9 sectors expanded. Finally, construction expanded for a fourth consecutive month, but only because the apartment sector is growing strongly; all other sectors are contracting.

The BOE maintained rates this week, offering the following assessment of the UK economy:

Twelve-month CPI inflation remained at -0.1% in October, a little more than 2 percentage points below the inflation target.Inflation is expected to have been slightly positive in November, and is projected to rise further as some of the large falls in energy and food prices at the turn of last year drop out of the annual comparison. Nevertheless, core inflation remains subdued, and CPI inflation is expected to stay below 1% until the second half of next year.

Leave A Comment